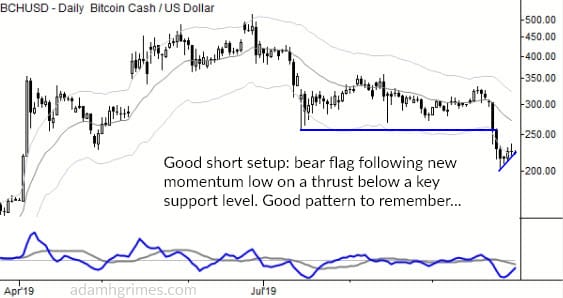

Technical Patterns

The power of an inside bar

Just a quick lesson here, but an important one. Take a look at the chart above. Was there anything that could have helped us predict the breakdown on that last bar? There's a lot going on on any chart. In this case, we had a long bull flag