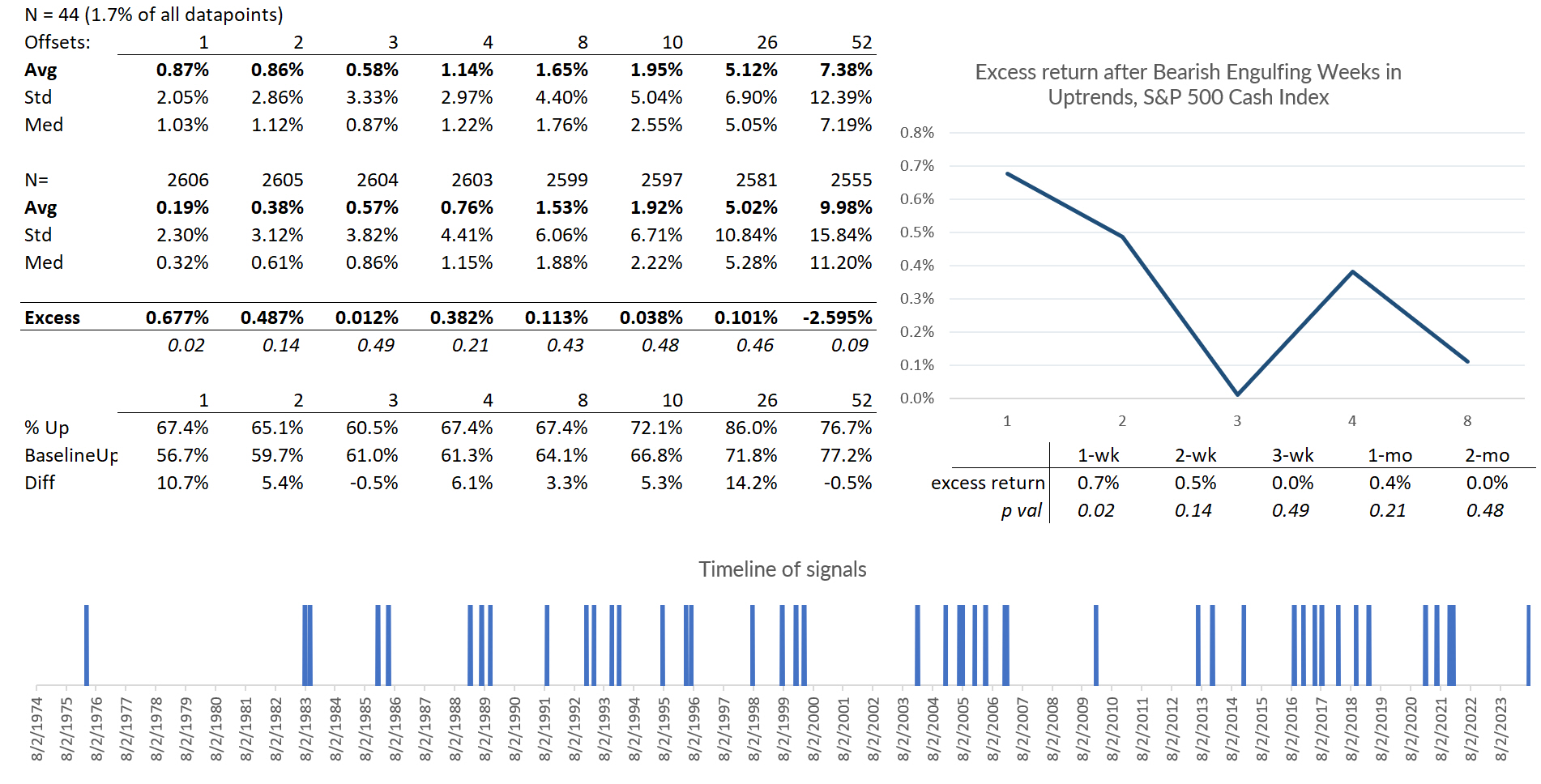

Consistent Trading Through Repeating Patterns: Lessons from 3,800 Days of Market Study

Every day, I provide detailed market analysis for MarketLife members, focusing on daily setups. We focus primarily on the daily timeframe, and cover markets in two tranches: US-listed futures (and…