Trailing stops: 9 ideas you can use today

Trade management is at least as important as trade entry, and maybe a lot more important. There are two main tools for trading management: profit targets and stops. From these two simple tools, complexities explode because there are many choices—where do we put them initially? Do we move them? When and how much? Ever cancel them? Any other possibilities, such as a time stop? If we exit, do we ever add back? Do we consider other positions/correlation?

Before you trade, you should have a pretty solid answer to most of these questions. This is part of developing your trading plan, and it’s a major focus in my free trading course. (If you haven’t seen the course, you really should check it out. Registration is required, but it is completely, totally free.)

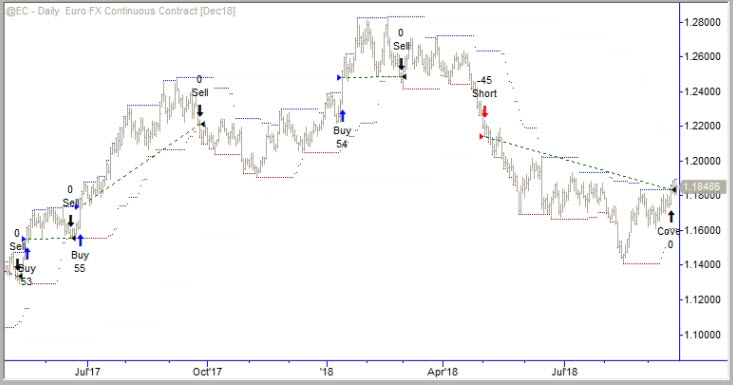

Let’s narrow the scope today and focus on trailing stops. These are stops that are moved as the trade develops. Knowing when and how to move them is a key part of trade management. Here are some ideas:

- In general, when the trade moves in our favor, we want to move the stop to reduce open risk in the trade.

- Conversely, if the trade doesn’t move and just sits around our entry price, we can still move the stop. Move it enough, and you’re almost sure to get stopped out. This can be an effective alternative to a time stop (which is simply to exit if you don’t have a profit in N bars.)

- We can use market structure, specifically previous pivot highs and lows, to locate stops.

- Consider whether to put stops at, inside, or just outside of those previous pivots (which we can think might offer some support/resistance.) Most traders will default to outside the support/resistance, with the logic that they do not want to be stopped out of trades that are still valid.

- Another possibility is to simply trail a stop at the lowest low of the past 2, 3, 4, or 5 days. (This only works in a strongly trending market.)

- When a market makes a very big one bar move in the direction of the trade, we can often move the stop into the range of that bar on the following bar. Usually, this is probably too tight, but our goal should be to give back as little profit as possible following an unexpected windfall.

- There are some technical indicators/tools, such as Parabolic SAR and Chandelier stops that can be used as trailing stops. Like everything else you use, you should understand the nuances of the tool before you bring it into your system.

- Simply using the highest high or lowest low of the past N days gives you a market-structure based stop. (These are often called Donchian channels.) Choose your value of N depending on the type of entry you use and your intended holding period.

- Moving averages are another possibility. Though they do not test out well in quantitative tests, they have the advantage of being a simple, clear level. Having a plan is better than no plan at all.