How many emails do you get promising to show you how to find “hot stocks now”? How many screeners out there want to show you the movers and shakers in the market? How much attention does the media focus on big movers, and how much does social media explode when a stock makes a big move? So much–too much–of our attention is these hot and sexy markets.

How many emails do you get promising to show you how to find “hot stocks now”? How many screeners out there want to show you the movers and shakers in the market? How much attention does the media focus on big movers, and how much does social media explode when a stock makes a big move? So much–too much–of our attention is these hot and sexy markets.

There are, of course, good reasons why we want to know what is moving. Prices moving usually reflect information coming into the market, so the smart trader can untangle some of the web of news, headlines, and information flow by understanding what is moving at any given time. However, too many people spend time chasing hot markets, and often see that the hot markets go dead and dull time after time. (There’s a good reason for this too: volatility is cyclical. High volatility leads to lower volatility, and vice versa.) These quiet markets also demand focus, discipline, and the proper attention as they offer some interesting opportunities, but are fraught with many challenges and dangers. Here are some things you probably need to know about quiet markets and market conditions:

- Quiet markets conditions don’t last forever. True, some stocks simply stop trading and basically “go away” and some currencies slip into obscurity for decades. In general, though, active markets go through periods of relative activity and inactivity. The inactive periods–the dull, dead, and boring times–give way to better moves. Frustrating, dull markets eventually lead to good trading conditions. Don’t lose track of quiet markets.

- Quiet markets set up clean(er) moves. One quantitative element of price behavior is volatility compression; when a market is very quiet, there is a tendency for the next move to be sharp, clean, and directional. The typical chopping around, headfakes, and mean reversion tend to be muted after volatility compression. Breakouts work better, and, in general, trades are cleaner if you can catch the moment where quiet markets end and trending markets begin. To do this, you have to focus on those quiet markets. Do not lose track of quiet markets!

- Quiet markets encourage mistakes. When quiet markets break out into trends, volatility explodes–it’s not uncommon to see volatility become three or four times higher in a single day than it has been for weeks. Because market volatility is often directly tied to the emotions of market participants, people tend to make emotional mistakes. (But wait, there’s more…) These inflection points also cause difficulties for systematic approaches and for quantitative tools. For instance, we often set stops based on some function of volatility (this is one of the best ways to set stops and targets.) However, if tomorrow’s volatility is some huge multiple of today’s volatility, stops set on today’s volatility may be badly misplaced. There are no easy solutions to these issues, but do what you can to protect yourself from the emotional shifts, and make sure you understand the potential systematic issues.

- Trading within quiet markets is difficult, so you must have a plan. Quiet markets are usually reflective of consolidation, and price movement within consolidation areas tends to be pretty random. It’s very hard to find winning trades with an edge, so you could reasonably make an argument to avoid trading within consolidation. That’s all well and good, but keep in mind that the inflection points can offer good opportunities. Don’t get chopped up in the consolidation, but don’t miss those breakouts. There’s also a tie-in here to point #3: quiet markets encourage traders to trade in frustration, getting chopped up as tantalizing trade opportunities vanish one after the other. It looks like there are good trades here, but it’s mostly random illusion. Have a plan and trade the plan.

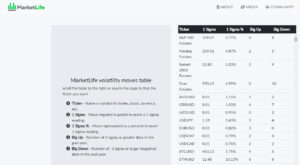

- Quiet markets are boring, but focus is rewarded. No one wants to talk about some market that is sitting in a 2% range for weeks, and the media quickly loses interest when markets go into consolidation. You, as a trader or investor, cannot. No one is going to do this work for you. It’s hard work to maintain focus when that focus is not rewarded today, tomorrow, or even next week, but you must do so. Know where the opportunities are, and monitor market conditions for shifts that might mark significant inflections. For some traders, a daily look at a handful of markets is enough, but other traders might consider setting alerts or using other screening tools.

Obviously, this topic is relevant to today’s markets. After a screaming start to 2016, many asset classes have settled into boring trends and trading ranges. In fact, I could easily argue that the stock market has been in a long range since 2014 (and it’s been amusing to watch technicians call for a crash every few months!) Oil is quiet, the USD is quiet, and precious metals have gone dead and dull. Grains? Showing some life after being dull for many months. Part of a professional trading plan is understanding the rhythm of the markets, and where we are in the bigger market cycle.

Welcome Back ! Good to Hear from You Again, Thank You 🙂

Nice to see another blog post! You’ve been quiet, just like the markets 😉

Pingback: Dash of Insight| Weighing the Week Ahead: Is Small Employment Growth Big News for Stocks?

Pingback: Weighing The Week Ahead: Is Small Employment Growth Big News For Stocks? – Seeking Alpha – Investing Signal

Pingback: Weighing The Week Ahead: Is Small Employment Growth Big News For Stocks? – Seeking Alpha – Pristine Investor

Pingback: Weighing The Week Ahead: Is Small Employment Growth Big News For Stocks? – Seeking Alpha – The Weekly Options Trader

Pingback: Indicator Update: Is small employment growth big news for stocks? – Minyanville.com – Investing Signal

Pingback: Indicator Update: Is small employment growth big news for stocks? – Minyanville.com – Tradersville

Pingback: Indicator Update: Is small employment growth big news for stocks? – Minyanville.com – The Weekly Options Trader

Pingback: Indicator Update: Is small employment growth big news for stocks? – Minyanville.com – Average Joe Options

Pingback: Indicator Update: Is small employment growth big news for stocks? – Minyanville.com – Pristine Investor

Pingback: Indicator Update: Is small employment growth big news for stocks? – Minyanville.com – Short Term Wealth

Pingback: Weighing The Week Ahead: Is Small Employment Growth Big News For Stocks? – Seeking Alpha – Short Term Wealth

Pingback: Traderwave Weekly - Can You Replace Your Income Through Trading?

Pingback: Weak Employment Report Big News for Stocks? - TradingGods.net