I’ve written on this topic before, but we just had a good example in the market, so it’s a great time to revisit. Many intraday traders find that most of a month’s profits come from one or two exceptional trend days in the month; it’s logical, then, that we would want to focus attention on finding those trend days in advance. If we can do so, we know what days might reward a more aggressive application of risk, and which days we might be better off going for a walk or, at least, trading more lightly.

I use a number of tools and models to help quantify the probability of a trend day. Of course, nothing is perfect and anything we find only has a small tilt in probabilities; there are plenty of days we come in with a strong trend day setup and nothing happens–also, many days that had no clear setup but turn into a roaring 40+ point trend. Regardless, we can find tools that shift the probabilities a little bit in our favor. In trading, that’s all there is, but it’s enough.

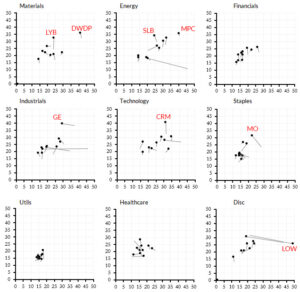

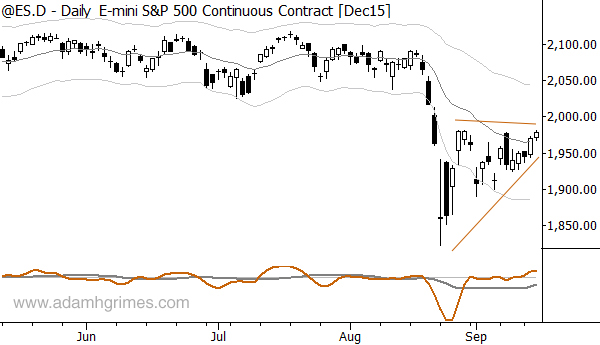

One of the best ways to look at market data, in my opinion, is to combine discretionary tools with statistical/quantitative tools. One way to say it is that we would like to have the wisdom of human intuition, but structured and informed by quantitative rigor, and here’s one way to do it. Take a look at the big picture daily setup on the S&P 500 futures. (All examples in this post use only New York session hour data.)

Volatility compression (read this, this, and this for more info) is one of the best setups for trend days, and we have it working on multiple timeframes in this market. Looking at the daily chart, above, we can see a triangle extending back several weeks. We don’t need to be precise about drawing lines on charts (because the market laughs at our lines), but the general concept is what matters. Now, let’s zoom in on a few days, and imagine we are evaluating the market at the close of the day marked with an arrow.

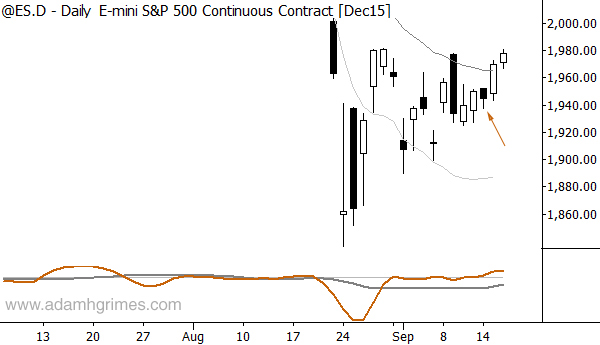

Here, we can see the arrow day was a tiny range day (trend day setup check). The previous few days were also small ranges (check). This was the second inside day in a row, in fact (check). All of these checks add up to give a high probability of a trend day the next session. In this case, everyone (myself included) assumed that the FOMC meeting this week would likely dampen volatility before the announcement, and many people were not expecting the market to move. However, by seeing this setup we were able to alert our research clients to be on guard for a trend day, and to take action if the market tipped its hand in the first hour.

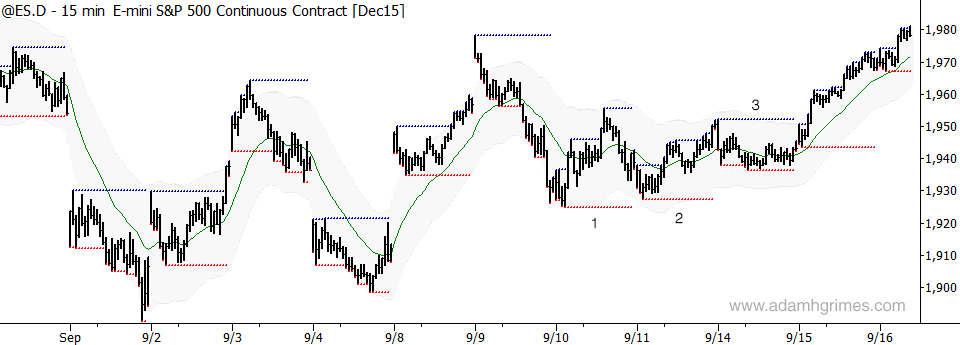

Let me show you another way to look at the same thing. Here is a 5 minute chart of the same market, with the day session high and low marked by red and blue dotted lines. If you’ve never seen a chart like this it can be confusing at first glance, but a few moments spent with it will help you see the divisions between trading days very clearly.

Consider the numbered days:

- A fairly unremarkable trending session, completely within the range of the previous day, which was strongly downtrending. We retraced a little less than half of that previous day. Next day (2) has a slight edge for trend extension down and we can expect a retest of the day 1 low.

- The retest didn’t happen and we spent the day chopping around in a quiet, boring session. This is volatility compression and we have a strong setup for a trend day the following day.

- Also did not happen here. Some of this trend day “stuff” is like fishing, and you never know when the fish is going to bite. (To take the silly analogy a step too far, we do have a tool that shows us where the fish are likely to be, so we can focus on those spots and times.) Day three turned out to be even tighter, giving a stronger setup for the following day.

There’s a lot more nuance possible here, but the point is that volatility compression can help intraday traders find best trading opportunities. For longer-term traders, there’s still good information here, for both trade management and entry trigger decisions. If you choose to incorporate this tool into your trading, make sure you understand how it works, make it a part of your written trading plan, and, like everything else, execute with perfect discipline.