I received a question from Alex, which appears to be a simple question. Digging deeper, it actually drives straight to the essence of intraday trading:

If I am wanting to trade intraday on the ES, are there some high probability ways to determine whether the day is likely to be a reversion to mean day or a trending day?

Just to be sure we’re on the same page here, intraday traders typically open and close positions within the same trading day. Many intraday traders do not carry any exposure overnight, which is a double-edged sword. On one hand, nothing bad can happen when you don’t have positions on, but, also, nothing good can happen. (There is evidence that much of the edge in financial markets is basically fair compensation for carrying the risk of overnight positions, which is something I always encourage daytraders to consider.)

Since a daytrader’s entire universe is that space between the open and close, one of the most important questions for a daytrader to ask is “is today a day that I should look to hold for a big trend move, or should I take a hit-and-run approach, taking smaller profits as they are available.” The elusive trend day is a focus for many intraday traders, as many traders make their whole month on a good trend day; on the other hand, fighting a trend day can easily cost you many weeks or months of profits, so it pays to understand the trading environment.

Most days in most markets see more back and fill than they do continuation. It’s not at all uncommon to hear developing traders complain about the lack of followthrough, and come up with all kinds of arcane explanations for why the market hates them, or why trading is so much harder now than it was a few years ago. (I’ve personally been hearing these explanations constantly since the mid 1990’s, and I bet people were saying this long before! Plus ça change…)

The best solutions I have come up with for “predicting” trend days rely on a combination of quantitative and subjective tools. (Shameless plug for the Waverly Advisors research I write every day that now includes a section specifically targeted to intraday traders and that focuses on the identifying the probable “best trading plan” for the next trading day. If you haven’t seen this work, I’d love to have you check it out.) The subjective part is a little bit hard to teach, but I’m considering things like:

- The overall market environment

- How reactive the market has been to news and new information

- Any scheduled events that could be a catalyst

- Any expectations of surprises (which is a more meaningful concept than it seems!)

- Recent price action

- Recent price action on lower timeframes

- Action in related markets/assets and geographies

What we’re doing here is putting together a lot of different things, with a heavy weighting of many year’s experience, and this becomes one input into the model. However, there are a number of things that can be quantified, and these are equally important. Some factors that can tilt the scales, perhaps slightly, in favor of a trend day:

- Volatility compression, which can be measured in several ways

- Inside days often set up trend trends, and multiple inside days (i.e., inside day of inside day) may have a stronger edge. This, by the way, is lower timeframe volatility compression.

- Multiple days closing in the same direction can set up a snapback which can lead to a strong trend day

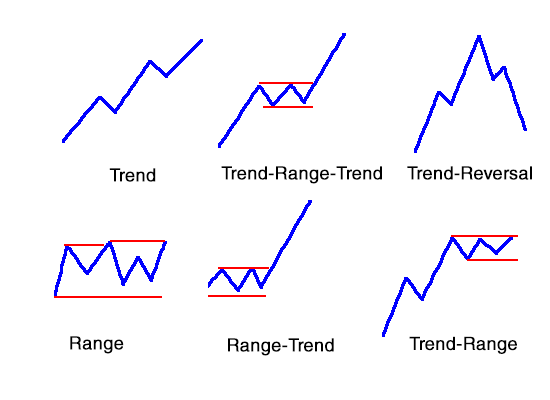

- Remember, trend days can come within higher timeframe consolidation. If you’re an intraday trader, don’t write a market off just because it’s in a trading range!

- Action around previous significant highs and lows may not have as much of an impact on the intraday character as we think it should.

- Lower timeframes trend to alternate trending/ranging, so a trend day is somewhat unlikely to follow another trend day.

- Tight afternoon ranges can set up an early morning trend

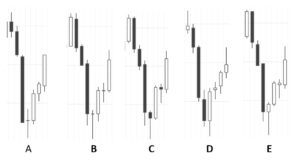

- Impossible to know the night before, but early morning action is critical:

- Is there a gap opening?

- Does it retrace or hold the gap early on?

- What did Europe do in the last half of the trading day?

- What is the action in bonds, currencies, and gold?

- Any surprise news items affecting the open?

- A good trend usually makes itself known in the first hour, so your gameplan from the night before will often require some early morning adjustments.

There’s no easy answer to this question. If there was, we’d all just wait for the trend day that comes, on average, about once a month, and pile on that day while we watch Netflix the rest of the month. This, however, is not how professional trading works. Even if we capitalize effectively on the trend day, trading in other other environments, perhaps with reduced risk, often gives us more information about the market and its character than we could glean from any analytical process or tool.

Trading is a skill. Analysis is one part of that skill, but work to develop the skill set of competent, professional trading.

SGX A50 has been so volatile in recent days. It was nearly impossible to hold any position overnight. Will you suggest non day trader switch to lower time frame trading in this extreme volatile market?

It is heard that intraday trading should better use tick-chart instead of time-based-chart. Do you think using tick-chart has any edge for day traders?