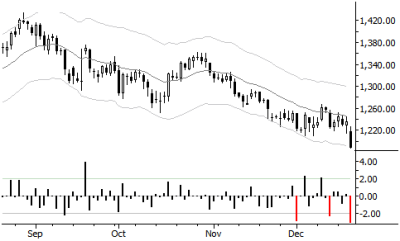

We have been short Gold in our daily research several times this year. The most recent short was initiated 9/23/13, but Gold has been a strong performer for us through much of the year.

This recent selloff has the potential to lead to a feedback loop and spark a much more serious selloff. Reasonable targets for the move probably lie below 900 (basis Feb 14 futures), and shorts are now justified using fairly tight stops. Chances are, precious metals are at a decision point—fail in the downtrend here, and we’re likely looking at sideways to up (and perhaps sharply up) over the next few weeks. Continue down from here, and… lookout below.

Be extremely cautious bottom fishing this market, and consider the impact on related stocks and stock sectors. Recent trading history has been benign, but there is potential for tremendous volatility if a selloff develops.

Hi

I am not able to log into the site. Message is

503: Service Temporarily Unavailable

Too many IP addresses accessing one secure area!

Please contact Support if you need assistance.

What could be the problem?

Rajesh