US Stocks stand at an important potential inflection. Structurally, we have seen much support for US stocks to emerge as the global relative strength leader, should stocks break out into another rally leg, and it is important to temper any natural bearishness. Yes, much of 2014 has been confusing, and there have been many conflicting technical signals, but this is normal of markets in consolidation. Furthermore, consolidation is healthy. We are certainly in a large-scale bull market–history will tell whether we are at the beginning, middle, or end of that bull market (for the record, my money is that we’re somewhere in the late beginning of that historic bull run.)–and large-scale consolidation is healthy for a bull market of this scope. Technicians have raised many legitimate concerns (e.g., lack of clear leadership, small cap underperformance, etc.), but most of these concerns would be valid in a clear rally leg; in a consolidation, most of what we see is noise and we’re usually better off ignoring noise.

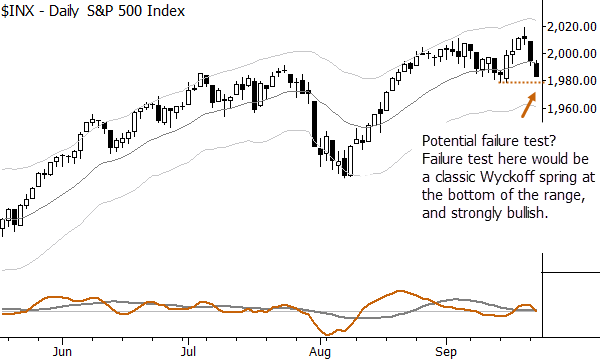

Though much of the bigger picture remains strongly bullish, the recent decline has shown that the bears may have some claws, and has presented challenges for heavy longs. We are now approaching a potentially significant structural points in US stocks. Take a look at the chart off the S&P 500 (cash) index:

I have written many times before that I think too much attention is paid to support and resistance. Markets simply do not have multiple, significant “levels”, but our brains can easily mislead us and make us think levels look better than they actually are. The only defense is proper statistical testing, and it’s very difficult to test action around levels. Regardless, there are times, particularly when a market approaches a clear and visible pivot, that these levels can take on more significance and where a level can matter. The S&P 500 is approaching such a level right now.

Should we trade below that previous pivot (which is about 1978.50, on the cash index) and then close strongly above, we will have a good failure test against that pivot which can be motivation for a long trade. This trade could be even more significant because of where it comes in the overall market structure. A failure test here would be a classical Wyckoff “spring”, a possible sign of accumulation, and could be a point from which the market rallies strongly to take out the highs. This is all possible, but it would depend on the proper followthrough from that failure test.

Should the market penetrate this level to the downside and continue lower, then the picture becomes more complicated. This is not necessarily the end of the uptrend, but it would raise more concerns and could likely push us into a longer period of consolidation. Always assume that the market will do whatever it can to hurt the most people–this is not cynicism, it is a subjective way to understand how the psychology of the market causes patterns to unfold.

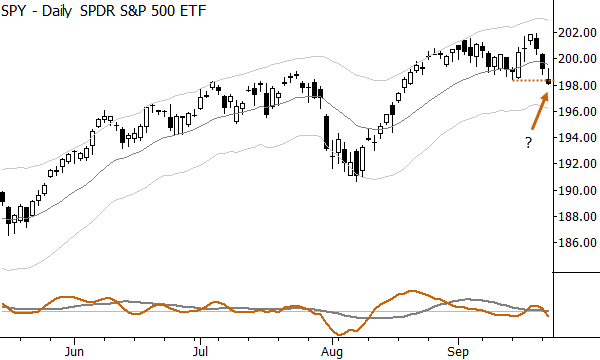

One more, very important, point. Take a look at the chart of the SPY, which seems to show a very different picture with respect to that previous pivot:

Why did the SPY close below that previous pivot, while the cash and futures are still above it? Simple: the SPY just paid a dividend. ((SPY will often differ from futures because futures trade basically 24 hours. In this case, the dividend is the critical point.)) When a stock (or ETP) pays a dividend, the price adjusts downward by the amount of the dividend, but, by standard convention (why?) we do not adjust price charts for dividends! (Let’s not even discuss split adjustments or rolls for futures contracts: The argument that support and resistance works because people “remember” the prices they traded at and will execute there again if price reaches those levels? Facile, but absolute hogwash if past prices “slide around” on charts–the entire foundation of the psychology of support and resistance is built on a very shaky intellectual foundation.) On 9/23/14 SPY closed 198.01 against the previous pivot of 198.38. The $0.94 dividend recent paid means that previous pivot should probably be around 199.32, with a simple addition adjustment to back out the dividend. ((ratio adjustment might be better.)) Don’t accept technical patterns at face value; always think about what the dots and lines on your charts actually mean. Always think deeply.

So, watch action in the S&P 500 tomorrow. For bulls, we have a clearly defined risk point, and the reassurance of a lot of bearish sentiment coming out on this decline. For bears, we know what should not happen for a good short–a spring at the bottom of the range would be a difficult pattern for shorts. Rather than trying to predict the future, it can be helpful to outline possible price paths and what they might mean for the future short-term direction of the market.

Thank You ! Great Insights !

What a great anticipation and read yesterday on the market. Awesome.

Thank you (you and A_Joe, both), but the point here is much more the thought process and type of analysis that I find useful. It’s nice when we can be right lol, but the concepts are really much more valuable than any specific market call.