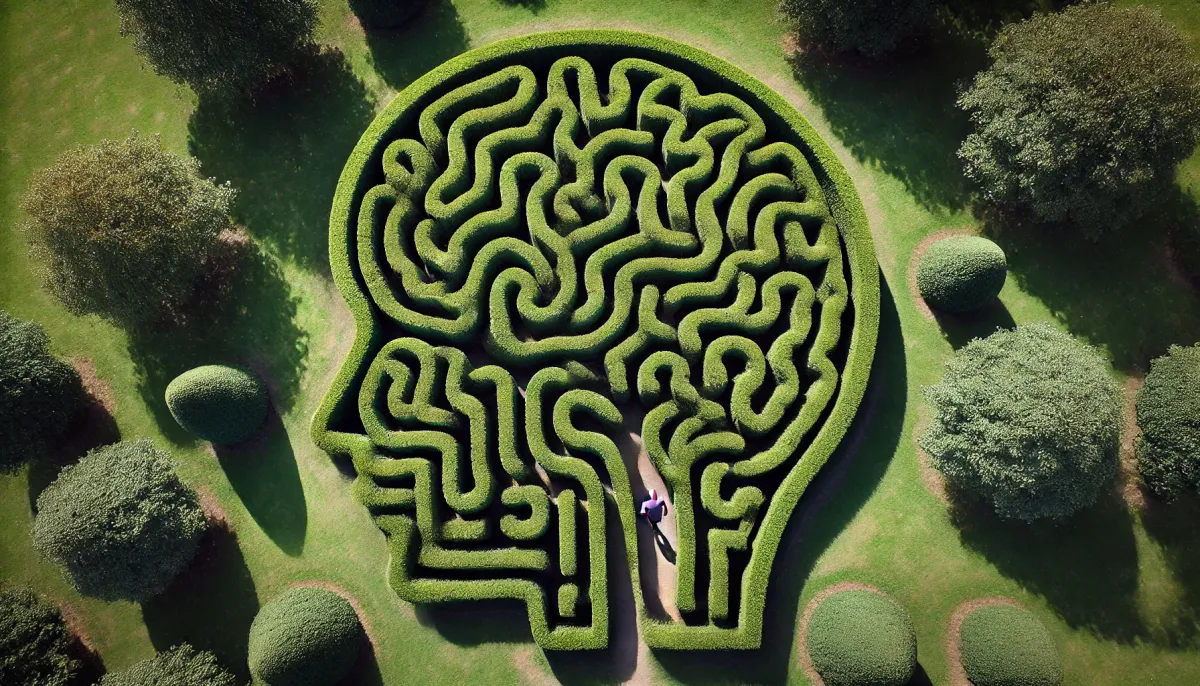

Trading with Head and Heart: Balancing Strategy and Psychology

I received an email from a reader named Doug, about my recent blog post:

“…I'm definitely a skeptic with the psychology portion of trading - but as a futures day-trader, it may be even more important for me. I'm finally at the point where I have my strategy and have the knowledge, but am still breaking even - so willing to go out on a limb and open my mind up to some of this stuff…”

Doug’s thoughts are a snapshot of my journey to understand trading psychology, spanning many decades and types of trading. I’ve been a skeptic at times, too.

One of the persistent myths among trading educators is some variation of “trading is all psychology,” or 95% psychology, or another made-up statistic. One of the most popular books on trading psychology suggests that finding an edge is trivial, that good systems are lying around just waiting for you to apply them; the author even claims that you can contact him directly, and he will give you an edge if you can’t find one yourself.

This, of course, is untrue. It’s quite difficult to find and maintain an approach with an edge. Traders spend thousands of hours of work to find such a system, and you aren’t going to be successful unless you have a real edge. But even if you do have an edge, you may find yourself unable to apply it. And here is where trading psychology becomes important.

Trading is not all psychology. It’s not even mostly psychology, but psychology is critically important. And there are times when psychology is all that stands between you and success.

Emotions

Trading is an emotional business. No matter how logical or intellectual you are, or if you choose an approach designed to minimize emotions, you’ll still have emotional reactions. This is because every decision we make always includes both rational analysis and emotion. This is how the human mind works—there is always emotion. Trying to eliminate emotion is not the goal.

Don’t hide from your emotions, and don’t think of them as an obstacle to be overcome. Yes, there will be times when they drive behavior—and this is almost always bad—but they are a part of you, and a part of your decision making process, that you must fully integrate.

So what to do?

The key is to understand your emotional makeup and how you react to situations in the market. Different traders have different strengths and weaknesses. “Know thyself” really is the key: are you good under pressure? When do you get frustrated? How do you decompress when emotions are clouding your judgment? Can you work on something for many months or years without seeing good return?

I firmly believe that nearly anyone can find a way to take money out of the market. Of course, it’s far easier to be on the other side of that—far easier to find ways to lose money in the market. But you don’t stand a chance, in the long run, unless you truly understand yourself and how your strengths and weaknesses can both be best put to use in the marketplace.

I think a good solution involves both strategy and tactics.

Tactical trading psychology

The tactical side of trading psychology is straightforward: find patterns in your mistakes, and see where emotions may be causing or reinforcing those mistakes. Then you can apply simple techniques like pattern interrupts (written about in my first book) to manage these issues.

A little bit of journaling and introspection go a long way here, and most traders will find their own solutions to problems with a few weeks of focused work.

But dealing with problems when they arise is kind of like running around a leaking boat and slapping duct tape on each hole in the boat. It might make the boat sink slower, but it doesn’t solve your problems. It doesn’t get you where you want to be.

Big picture trading psychology

In my opinion, good trading psychology solutions must be, above all, practical. One could spend a lifetime in introspection, in therapy, and working on oneself. But that does not necessarily connect a trader to success.

Without writing a small book here, I can offer a few guidelines:

- Self-understanding can be a revelation, and even seemingly small insights can make a big difference. If you’ve never done this work, you will be amazed at the return from a dozen hours invested.

- For many traders, it comes down to understanding motivations. And the real issue is that motivations are not always what we think they are. Understanding your “why”—understanding your true reasons for wanting to trade will show you the direction in which you will find solutions.

- The psychology of grit and perseverance are also key, but balanced approach is essential. Don’t forget the carrot for the stick. Reward yourself for successes along the way.

If you’ve been stuck in the “it’s all psychology” mindset, you’ve probably neglected methodology, and a little rigor on that front will help. If you have been completely ignoring psychology, thinking you can “white knuckle” your way to success, or that you are somehow immune from the human conditions, just let me gently suggest that neither of those things are true.

A balanced look at the dynamics of trading psychology, as they play out in the currents of your own mind, will lead you to success you may never have thought possible.