Simple things work

Over the past few weeks, I've been hanging out a bit more in internet trading rooms and groups. It's been a good reminder of the kinds of questions and mistakes people make as they are learning about markets. Room moderators strut (including one who told his group he made mistakes that cost him millions of dollars last year, but no biggie because his life wouldn't change either way). People give horrible advice (you are losing on a trade? Hedge it with options! While you're at it, try penny stocks. I made 10,000% yesterday!) And arguments over market direction are actually thinly veiled expressions of fear, hate, and political sentiment. (And of course the Illuminati need to hold gold prices down. Do you know how much gold they need to cover the pyramids they use to communicate with Xenu? Time travel is expensive. At least they do not manipulate the price of aluminum, so you can still make those hats to keep the satellite waves out of your brain...)

I'm having a little fun at their expense (and I'm very aware that I'm about to be kicked out of every trading forum I have joined), but that's not the point of this post. The point is that there is a better way--there are patterns in markets that can show you where those markets are likely to go. If these patterns are hard to see, it might because they are simpler than anyone expects. Trading them is not trivial; the edge they provide is very small. The only way they will work is over a large set of trades, so all the things you hear about--discipline, risk control, process, consistency--these are all essential because they keep you in the game long enough to let the small edge work in your favor. But the basic patterns of the market are not difficult to read.

Many of the more complicated patterns in the market are actually variations of simple patterns. Of all the patterns I know and use, the best, and probably the most useful, is the pullback. Now, trading pullbacks in trends is a well-known strategy. I gave a presentation recently explaining, in detail, how to find pullbacks, where to enter, where to put stops, how to manage the trades as they develop, and backed it up with about a dozen examples of pullbacks from recent market action--showing some working and some that failed. In the middle of it, someone raised his hand and asked "are you going to be talking about more interesting stuff? Everyone knows about pullbacks..." I gently asked him how many pullbacks he had actually traded and how they had worked out--a question to which he had no answer.

I guess the point of this post is this: if you're looking for a way to read the market, understanding pullbacks in trends is a good place to start. If you can read pullbacks well, you can understand which trends are likely to continue and which are likely to fail, and you can also know where to get in with reasonable stop points, and where to take profits. There's a lot of nuance to these patterns, but the basic pattern is extremely simple. (For more reading, check out this post, this one, and then you can scour the archives for other posts. If you want to build a complete trading system around this idea, then check out my (completely free) trading course here.)

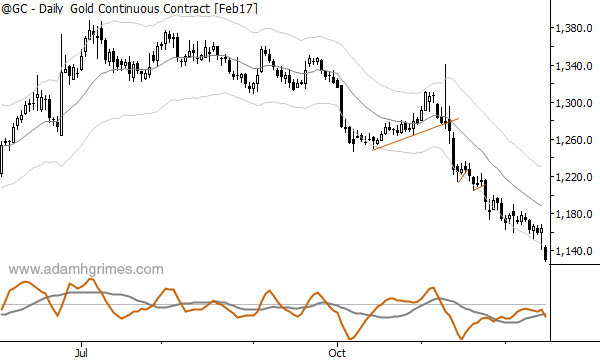

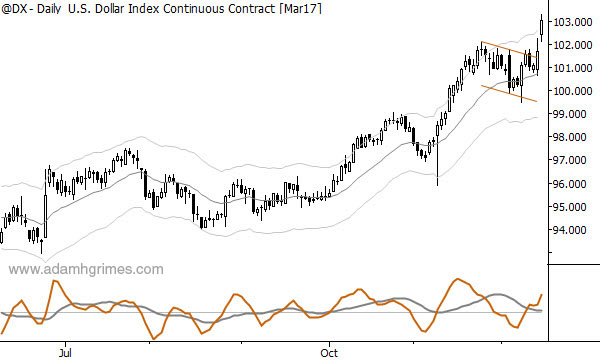

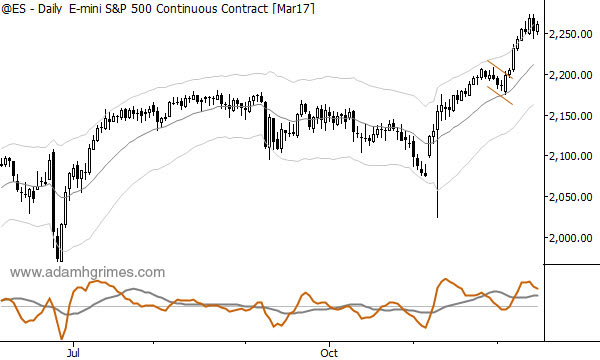

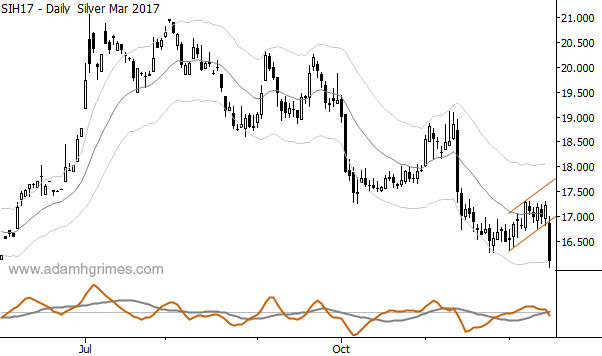

Let me leave you with these charts. Here are four examples of simple pullback patterns drawn from recent market action (daily charts). These are not "after the fact" charts--all of these were identified before the moves developed. Of course, these are trades that worked, and they don't all work. But they do, over a large set of trades, provide a strong statistical edge; you can build a trading program on that edge. You can build a career on that edge. Simple patterns work.