(Continued from this post.)

I left you yesterday having discussed filtering for volume and activity and volatility. Today, let’s dig a bit deeper and, first, look at filtering for certain other trading characteristics, then let’s ask some of the questions that we always should ask when doing any quantitative work like this.

Filtering for relative strength

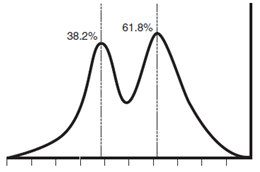

One of the most important factors for my style of stock trading has always been relative strength. Right away, we are led to a key question: how to measure that relative strength? There are many different ways, but one idea that is not so commonly used is to take the position of the stock within volatility-derived bands (Bollingers or Keltners, for instance) as a measure of short-term relative strength. At first, this might seem a bit strange, but think about what these bands show: how far the stock has been able to move from its own average price, measured as some multiple of some measure of its own volatility. It might seem counterintuitive that you could have a strongly uptrending stock that is dwarfed in RS rankings by a downtrending stock that has a sharp pop, but all I can say is give it a try.

This is a measure that has served me well for years, and we feature it in several ways in the research I write for Waverly Advisors. A number of the stock screens as well as the quantitative models use a measure like this, and we publish the raw measure on many of our screens and scans.

Sectors?

It is completely logical that we might start from a top down approach, and much of the investment literature suggests doing so. For some people, this is an important part of the process, but you might find that a relative strength approach “backs you into” this top down approach from the other direction. You could identify strongest sectors and then look for trading candidates within those sectors (the standard approach), or you could start from a large relative strength list and you’d probably discover that the leading sectors were already well represented in that scan. There are many ways to slice a tomato.

Filtering for other characteristics

You can obviously extend the idea of filtering, but, at some point, you go beyond screens and into creating actual trading systems. Nothing wrong with that, but just be aware of what you’re doing. In fact, it might be most intellectually honest to think of the screening process as the first step of a trading system, with your discretionary (or further systematic) inputs as the next steps. Without going into too much detail, one measure that might be interesting to consider is a measure of stability. For instance, if you are a trader who likes to sell option premium, it may make sense to do so in stocks that have not, historically, been subject to large price distortions. (No options pricing methodology can account for, say, +/- 4.0 sigma moves.) On the other hand, if you’re a short term breakout trader, maybe you would prefer these “unstable” stocks. Just something a little off the beaten path to consider, and this brings us to my next point…

Some questions

There are mundane questions we should ask, like exactly how do we calculate these measures (arguably, the least important question) and over what time periods should we look. For instance, imagine we are looking at average volume over a very long (1+ year) time period. In this case, a stock that suddenly becomes active is going to have to be active for a long time before that average is much affected. Might it make sense to use a shorter average to be more responsive to recent data? However, what about distortions due to corporate events or earnings? If a stock announces earnings and volume spikes, why would we assume that volume is likely to continue? It’s typical for volume to quickly abate after an event like this. (One possibility might be to use an average period that always captures an earnings event, basically removing the “seasonal” influence.) None of these questions are deal breakers; some answers are better than others, but the most important thing is probably to be consistent.

There are mundane questions we should ask, like exactly how do we calculate these measures (arguably, the least important question) and over what time periods should we look. For instance, imagine we are looking at average volume over a very long (1+ year) time period. In this case, a stock that suddenly becomes active is going to have to be active for a long time before that average is much affected. Might it make sense to use a shorter average to be more responsive to recent data? However, what about distortions due to corporate events or earnings? If a stock announces earnings and volume spikes, why would we assume that volume is likely to continue? It’s typical for volume to quickly abate after an event like this. (One possibility might be to use an average period that always captures an earnings event, basically removing the “seasonal” influence.) None of these questions are deal breakers; some answers are better than others, but the most important thing is probably to be consistent.

Closely related is the question of how to deal with momentary distortions. A lazy, 50,000 share/day stock can suddenly become a 1,000,000 share/day stock when some news hits, and be a very good trading candidate for certain styles of trading. How often do we rescan our universe and how will we catch stocks like this? (Or do we care? It depends on your style and what you’re trying to accomplish.)

More serious questions center around how persistent these effects actually are. Anytime we are doing any data analysis, we are, of course, analyzing history. We make some assumptions that the future will look something, somewhat like the past, but how good is that assumption? That is a little question, dropped casually here, that should occupy many hours and days of your thought if you are a technical/quantitative trader. In fact, it is the question for some styles of trading, but it’s also one that traditional technical analysis has solidly ignored. Don’t be afraid of hard questions.

Conclusions

Screens are necessary simply because there are too many listed tickers for a human trader to dig through with any degree of regularity. We have looked at ideas for screening for volume, activity, range, relative strength, and other trading characteristics. Some of these ideas are more applicable to certain styles of trading than others, but it is important that you understand what you are trying to accomplish. To do that, it is first necessary to understand who you are as a trader, but that’s another post. 🙂 Last, we finished with some hard questions about persistence and how well quantitative factors carry into the future. Don’t be afraid of asking these hard questions.

I’ve been playing this morning with with the volatility scoring relative strength but I’m missing something. As I understand, if a stock has been correcting sharply then quickly reverses that transition will exaggerate the actual relative strength measure. This would however be a regression to the mean trade that could break down suddenly rather then a trending stock that has high relative strength.

So I think you are suggesting a more ideal candidate will be a stock that has a higher relative strength measure but is also within let’s say within 1 standard deviation of its moving average.

It’s a screening method, which means it’s the first step. To me, I might then look for pullbacks, which gets us somewhere near what you’re describing. Yes, I think you’re on track with this.