Markets unlocked 2/13/23

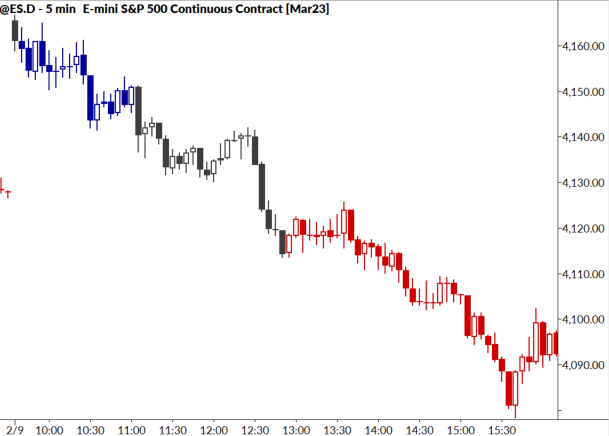

Last week saw several rounds of strong selling pressure in stock indexes, including a classic downtrend day on Thursday. (See chart below, just for the illustration of a textbook-perfect downtrend!) However, this weakness may take on a different significance when put in longer-term context.

A look at the chart at the top of this post reminds us that stocks are up significant over the past month and a half, and that this type of move often leads to a pullback or correction. This is part of the normal market cycle, and, in fact, is an affirmation of trend strength.

We do, however, find the market at a key short-term inflection point. Last week's action presents as an inside bar (meaning the weekly high is lower than the previous weekly high and the low is higher). This is a typical setup indicating volatility contraction, and pointing to a higher probability of a trend move out of the current consolidation.

Though near-term technical factors point to the upside. it would not take too much selling pressure to tile the scales back to balanced/neutral. Index traders can use reasonably tight stops on longs based on daily charts.

In the much longer-term, we still hold grave concerns related to the yield curve inversion, but this has little value for short-term action. Inverted yield curve signals have almost always led to a significant decline in stocks, but the signal sometimes precedes the selling by as much as two years. This is most certainly not a timing signal!

The week ahead (potentially market-moving data releases)

Monday: Ny Fed Inflation Expectations

Tuesday: CPI

Wednesday: Retails Sales, Industrial Production

Thursday: Jobless claims, Philly Fed, PPI

Friday: None

Note that any speeches from Fed Presidents are potential intraday catalysts. The market is reacting strongly to every hint of information from this quarter.