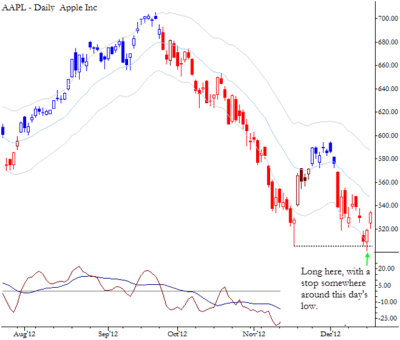

A few lessons and thoughts as a followup to yesterday’s post on APPL:

- Everyone in the world was talking about AAPL the day after the large decline about two weeks ago. Bloggers and media commentators were busy trying to be right and to explain why their view on Apple was correct. Daytraders were patting themselves on the back for catching some of the bounce. By comparison, no one was watching Apple yesterday when the “easy” trade set up.

- The best technical trades set up when no one is watching.

- Beware groupthink. Social media promotes groupthink.

- You have to understand the patterns and watch the market. The correct entry was on the close of the day of the failure test. If you waited, today gapped up and didn’t really look back. Knowing your patterns and probabilities gives you the confidence to trade an unpopular opinion.

- This is an example of a trade that worked easily. At this point, your stop should be a little bit below your entry. Yes, there is still gap risk, but actively tightening the stop is an important part of trade management. (Of course, you can overdo it and tighten too aggressively. Make sure you are responding to fluxing probabilities, not to your fear and emotions.)

- Maintain the discipline of taking partial profits at 1X your initial risk. Depending on where your entry and stop were, this level may have been hit, but is certainly very close.

I investigate these issues and show many examples of this pattern in The Art & Science of Technical Analysis.