Here we go… heading into the end of the year.

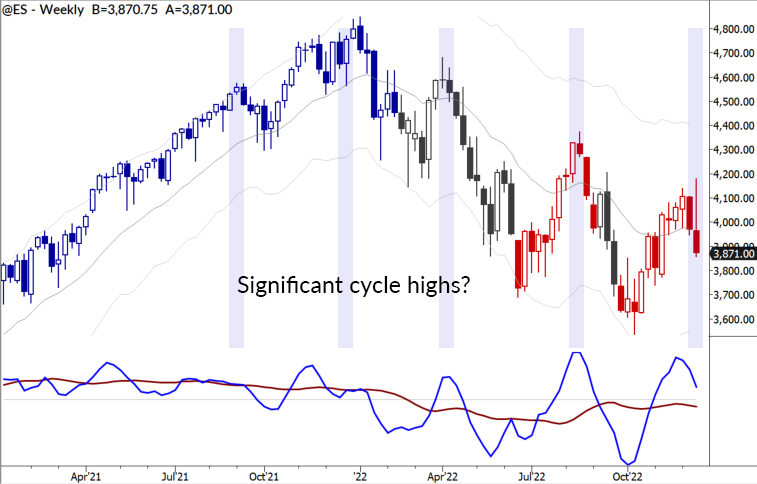

In terms of pure price patterns, there’s a reasonable chance that an intermediate-term cycle top is in place in major indexes. While this is not a factor we use to support decisions, it’s an interesting reinforcement of a number of other technical factors.

It’s worth spending a few moments marvelling at the degree of delusion that exists in the bullish camp. December seems to be a time that brings out the worst and weakest “statisticians” who flood the conversation with hopeful tidbits. As we well know, doing market statistics properly is difficult, and you don’t have something interesting to talk about all that often… but we’ll take that over sloppy stats anyday.

Just to summarize, here’s where I think we are, at this point in the market:

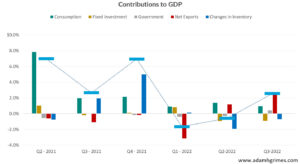

- We have significant and far-reaching overhangs that argue for much more stress to come over the next few years/quarters. Everything people are concerned about is only the tip of the iceberg.

- Technical factors, chief among those is price action (as always), now point to the downside.

- The supposed December seasonal effects are weak, under the best of circumstances, and have clearly been weakening in recent decades.

- We remain on guard for a significant decline in stocks.

- The long-term bullish bias and upward baseline drift in stocks is absolutely a real thing, and demands respect. If you are going to short, you have to pick your spots carefully and manage well.

Calendar (potentially market-moving datapoints)

- Monday; None

- Tuesday: Housing data (not likely market-moving)

- Wednesday: Existing Home Sales

- Thursday: Jobless claims, GDP (revision)

- Friday: PCE, Durable goods, New Home Sales