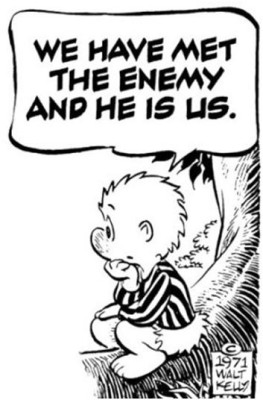

Have you ever sold a market right at the lows, or had your stop ticked out at the very high of a move? Ever entered a trade, gotten stopped out, and then repeated the same trade a few times in a row? Maybe done it more times than you should have? Do you ever feel like there is some great, unseen force working against you in the market? This is a nearly universal perception, and it is correct—there is a force working against you in the market. It is always there, and it can be overwhelmingly powerful. The surprise, for many traders, is that this force is you! The sum total of much of your cognitive machinery, biases, knowledge, and behaviors that suit you very well in nearly all other aspects of human existence work against you very consistently in the market. Knowing this is the first step to overcoming it. Let me share a brief passage from the chapter on “the Trader’s Mind” from my book, The Art and Science of Technical Analysis:

If you spend any time at all around traders, you will hear language like this: “Oh THEY got my stop again.” “Crap, that guy screwed me again. Can you believe that?” “Oh THEY always do that. That’s criminal! How can THEY always do this to me?” Traders tend to blame their losses on some great, nefarious, unseen THEM that is manipulating the markets behind the scenes—the US Government buying stock futures (the “Plunge Protection Team”), the floor traders manipulating markets, HFT and algos stealing from traders, or big banks heedlessly pushing markets around. Some or all of these things may happen, but here is the point: it doesn’t matter. You would perceive this intentionality in the market whether it exists or not. You would feel a great unseen THEM, because of the way your brain is wired. THEY may or may not be real, but your perception of a third party manipulating the market says much more about your own cognition than about the market itself.

Markets are blatantly manipulated at times, of this there is no doubt. However, market action is the end result of the competing activity of tens of thousands of traders, across many timeframes, with different objectives and goals; everything is folded into the patterns of market behavior and much of it nets out to noise. Rather than being angry when a market ticks your stop, either accept it as a natural event or, if your stop was placed incorrectly, modify your behavior. If this type of unwanted outcome happens frequently enough that you are this unhappy with it, you are probably doing something that is against the nature of the market. It is a simple choice: continue to be angry at the way the market moves, or align with it. (pp 350-351)

Well Said.

Gotta learn from your mistakes