Where are your risks?

Traders talk about and think about risk all the time, and for good reason: this is a risky business! A lot of things can go wrong, and some of those things can be very dangerous--a single mistake can effectively put a trader out of business, often in a matter of seconds. Understanding your risks is the first step in managing them.

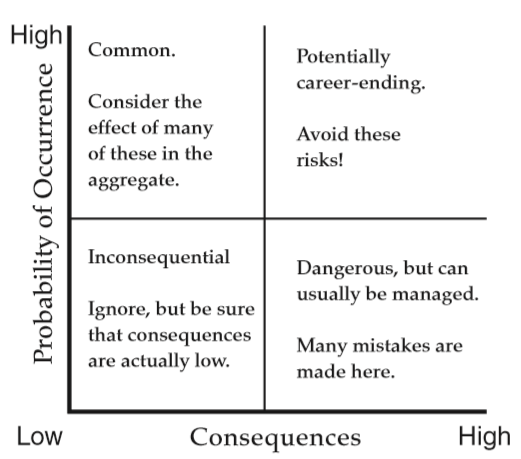

Risk can be counterintuitive; in so many walks of life, our goal is to reduce or to eliminate risk--reduce the risk of fire, take steps to reduce the chances of a car crash, and the list goes on. In trading, we want risk; we need the right kinds of risk because risk and opportunity are locked together--you cannot have one without the other. (Another way to say this: there's no free lunch.) However, they key is to take on the right kinds of risks, and to understand what those risks really are. Take a look at the following graph, which comes from p. 279 of my book:

Think about risks, in four big categories:

Low consequence / high probability of happening: These are the common risks, and managing them is routine. Because we see them so often, we can handle them easily, and even if we make a mistake the consequences are (usually) not that serious. These are common, forgiving mistakes. An example of this type of risk might be a simple, normal, losing trade. It's worth spending a few moments to make sure that you are categorizing risks appropriately; if you put something in the low consequence category that is not low consequence, bad things can happen!

Low consequence / low probability of happening: These risks can be disruptive, but they usually aren't terribly dangerous. (Imagine a longer-term trader losing his datafeed or internet connection for a moment. (And also think, for a moment, about how these risks are relative. For a short term trader, this might be a very high consequence event!)) The main dangers here are usually psychological, as the annoyance or break in the routine can lead to further mistakes, but these risks are usually not serious.

High consequence / high probability of happening: The true risk of an event (its expected value) is the product of the magnitude of the risk and the probability of that risk happening. By that math, these risks, in the upper right hand of the chart above, seem to be the most serious, but I would argue that they don't really matter for most traders. They are so serious and represent such an immediate risk to the trader--anyone who takes on these risks is quickly and efficiently eliminated from the game. You might look at these risks (e.g., violating your risk level per trade and then doubling up on the trade) as "just stupid". You can't take these kinds of risks and be a trader for very long.

High consequence / low probability: Here is where the true dangers, for most traders, lie. We, all humans, have poor intuition about these kinds of events. Maybe we choose to obsess about them, which reduces our ability to trade, or maybe we ignore them, and are blissfully blind to the upcoming day of reckoning. Options traders deal with these risks: anyone who has been in the business a while has heard stories of options traders who made money every week for 20 years, and who then lost their entire net worth in one catastrophic trade. If you're naked short premium, ask yourself what would happen if all those deltas went to 1.0--because some day, they will.

These risks exist for other traders too: if you swing trade stocks, there will be a day that your entire portfolio gaps far beyond stop levels due to an "act of God". If you short-term trade, there will be another Flash Crash that might take you to your margin limit if you are fading the move. This category, to paraphrase a well-known children's book, is where the wild things are. This category demands the best of your intention and discipline.

I'll be digging into risk management and risk/reward topics in more depth this week. Stay tuned.