Tracking sector flows

Understanding stock markets can be difficult. Which index should we look at? There are many ways to slice stocks: by market cap, by proprietary index methodology, by geography, by valuation, by sector, by industry, by looking at individual stocks... the choices can quickly spiral out of control.

Though there's no one, right answer, I've found solid results over the years by starting at the national level, then drilling down into market cap slices, and ending with a look at sectors. But there's a trick to the sector performance: you'll find more information if you look at it on a relative basis.

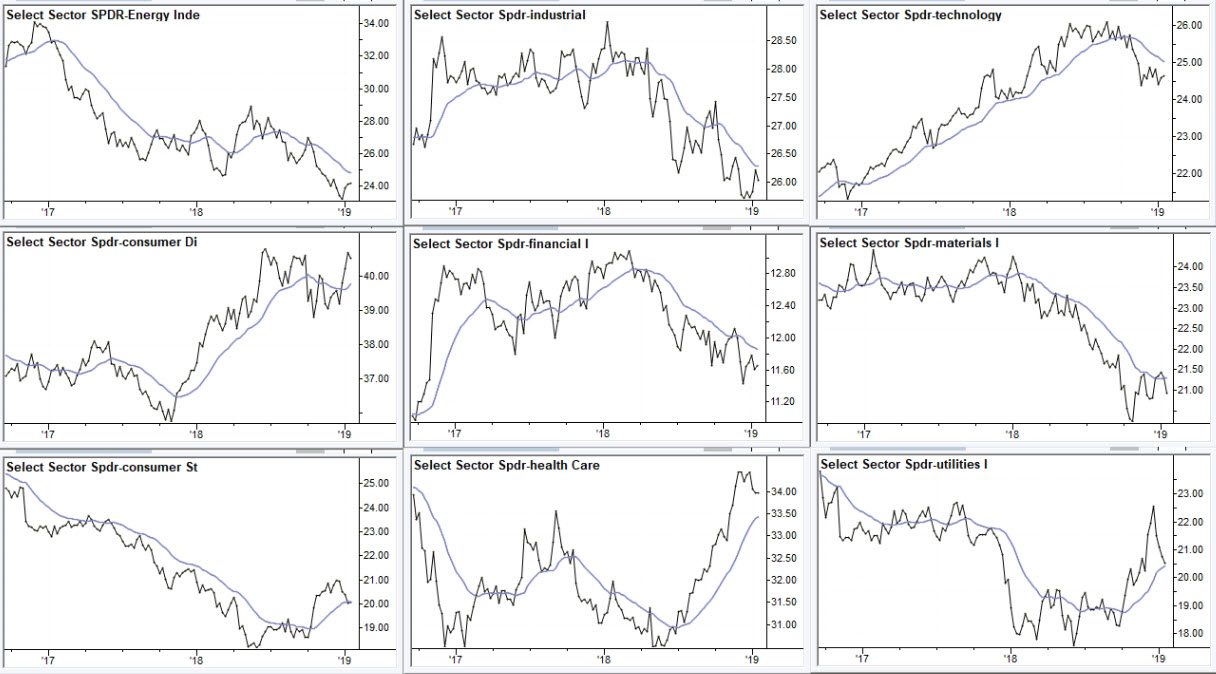

Relative to what? Take a look at the chart above, which shows major sectors relative to the S&P 500. (You can create similar charts on many free charting packages, or you can download the data in Excel and do it there. For each datapoint, simply divide the price of the index by the price of the S&P 500.) Interpreting this line is simple: if it's going up, the sector is outperforming the index. Down = underperformance, and sideways means it's tracking the index.

We can get a lot of information from this simple methodology. For instance, the 2018 shift in Technology stands out clearly. We can see that Energy has underperformed for a long time and continues to do so. We can see Defensive sectors rally when the market becomes weak overall. We can probably see impact of tariffs on Materials stocks. If we zoom out, we would get some understanding of just how persistent the Energy sector's underperformance is. I could go on...

I think there's much more value here than in doing analysis on charts of individual sectors. If you just look at charts, for example of the XLE, XLF, etc., you'll find yourself confused, more often than not. Patterns in individual sectors will "lose" to broad market influences, and it's not easy to see which sectors are leading and which are lagging--this is where the real information and value in sector analysis lies.

This isn't the only way to do it, but it's one of the simplest, most powerful, and best that I have found.