Time of day influences in currencies

In my last post, I looked at intraday activity in stock indexes; I had a few requests to repeat the same work, showing time of day influences--intraday volume (tick volume) and trend strength--for a handful of major currencies.

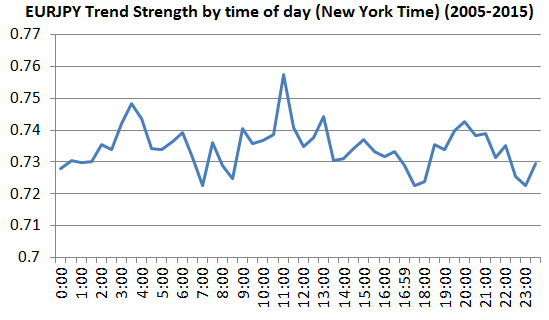

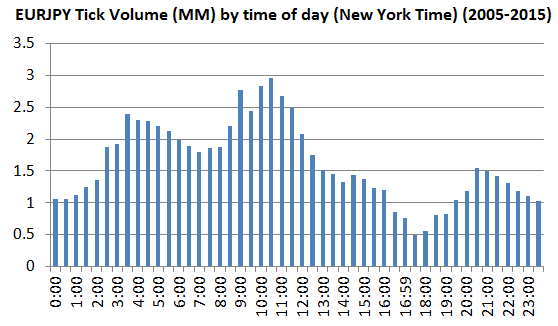

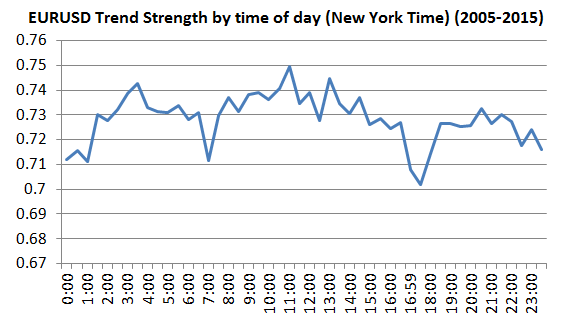

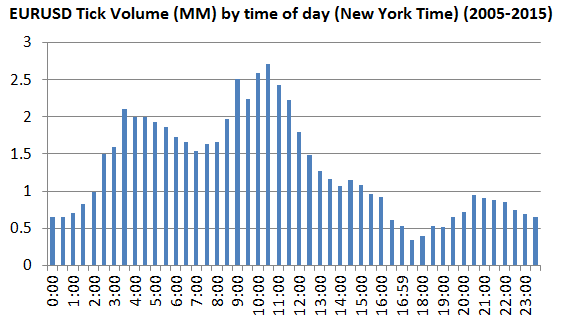

I'll just present the charts here without much commentary, as the patterns are probably less significant, in many ways, than they are in stock indexes. A few thoughts:

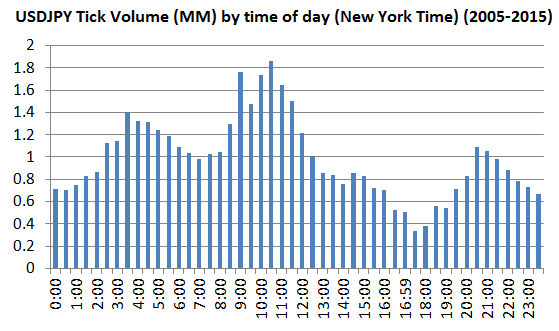

- It is easy to see the session opens that dominate trading in these currencies.

- The primacy of the US market is also clearly visible. Perhaps this is an effect that will change over the next ten years, and it certainly is worth watching.

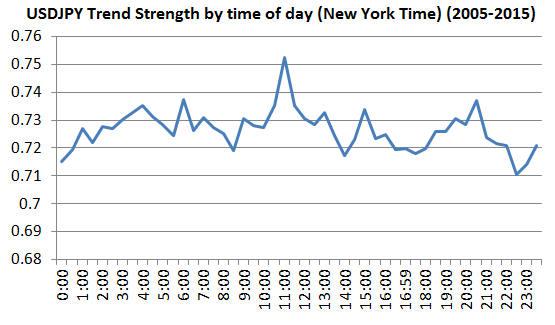

- The question of trend strength by time of day is more complicated, as it probably responds to a complex web of session openings and closings, scheduled news impacts, and action in related equity markets.

- It is, at least, possible to identify best and worst trending times of day, and these will come as no surprise to currency traders.

- In general, these effects may be less important and less significant for currency traders than they are for stock index traders.