Short term trading strategies that work

Over the past week or so, I've written a bit about short term trading strategies on my blog, and I've also done two podcasts (here and here.) Starting tomorrow, I'm going to start a few posts that will look into the statistical behavior of the trading day, but I thought it might be helpful, first, to look at some broad intraday trading ideas that either have worked for me, or have worked for other people.

No type of trading or timeframe is easy, but the challenges of daytrading are especially difficult. Whatever you do, you have to do between the open and close; distortions and risks can wipe out many profitable trades; and the psychological experience of daytrading can cover the full range from elation to utter despair back to elation (sometimes within the same minute!)--this isn't easy. However, I want to share a few ideas that I've seen work:

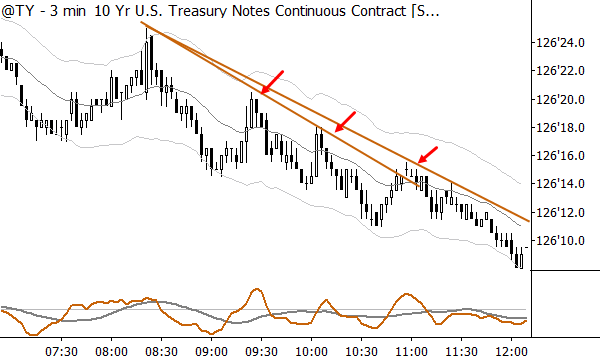

- Trade with the trend. Usually, "trend trading" means a channel breakout system with a very long-term perspective. Indexing or "buy and hold" is actually a kind of trend trading, with a multi-decade time horizon. You can do the same thing intraday, but I think you have to adapt. Trade pullbacks, breakouts of lower timeframes, opening range breakouts--these ideas work. They all take supremely focused risk management, but it's possible to put on a few entries and just "let them work" throughout the trading day. Note that many traders who trade this style hold at least partial exposures overnight.

- Fade moves. There are many ways to do this, and you can adapt for your personality. You can be a trader who sits watching for news in a stock, and then looks to trade around the overreactions. If you do this, you will need to scale in, scale in more, and be prepared to add to losing trades. Obviously, sometimes you will be full sized and wrong, so you have to limit your risk. There certainly are traders who do this, but it's a hard way to make a living. I traded a system for a few years that basically faded new highs and new lows on the S&P futures during the midday. With good discipline, you can pick up a few points pretty consistently doing so, and you could probably also extend the idea to individual stocks (though, I'd ask why you're taking the risk of an individual stock when you're basically making a market play!)

-

Trade opening tendencies. There are some trades around the open that work pretty well. Indexes tend to be "wrong" and reverse early on, gaps tend to close (except when they don't), and the opening range breakout idea is legendary. There are certainly things to be done here, but make sure you understand the math and risk.

-

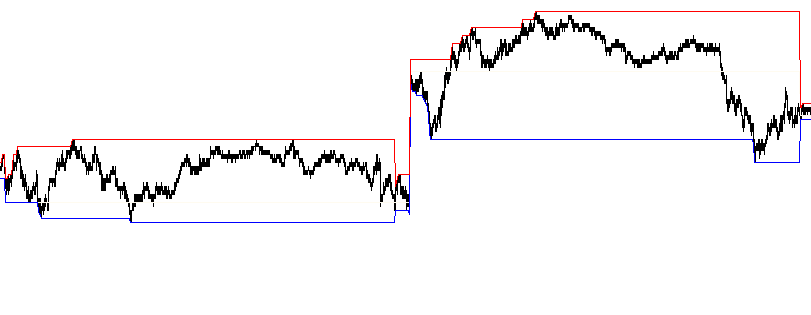

Trade breakouts. There are points where market activity is "bottled up", whether by order flow, anticipation of news, or due to some other reason. It takes skill, but it's certainly possible to trade around these points. Be aware that many of the textbook examples of breakout trades are carefully chosen; the real market is much messier and much harder to trade, but this is another idea that works for some traders.

I don't claim that this is an exhaustive list of everything that works, but it is everything that I, personally, have seen work. I'm very suspicious of ideas based on ratios, averages, simple price patterns, trend indicators (even if combined on multiple timeframes), though some of these may have a place in a supporting role in some strategies. As I said in the podcast, there's basically nothing new here with the exception of the structures around the open: we can trade with the trend or trade against the trend, but everything is complicated by the additional challenges and risks of daytrading. I'll continue tomorrow with a look at some of those stats around the open.