Silver is sitting on long-term support, with good potential downside below. There are a few things to think about here: First, this will not be a clean or easy trade; this is a trade that we have been stalking specifically for nearly a year, and have been leaning heavily short on precious metals since 2011. It seems so many people focus on short term trading, but managing a long term bias and having the patience to monitor a trade stretching over multiple years is a skill that is not much emphasized today, particularly in social media and on the internet. However, within that bias we found ourselves long numerous times as well, so there’s also something to be said for flexibility.

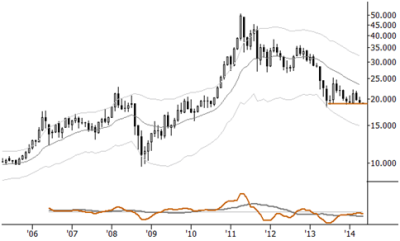

From this point on, silver is likely to be cleaner to read than gold, but the better long term potential is in gold. The monthly chart of silver shows a reasonably cleanly defined support area in the 18.50 – 19.00 range. (There’s another lesson: support and resistance are usually broad zones rather than precise prices.) Watch precious metals carefully for potential breakdowns in coming weeks, and, at the very least, goldbugs be warned—aggressive, emotionally-justified long positions in precious metals could get you hurt if this support level breaks.