One of the problems swing traders in stocks face is correlation; the sad reality is that stocks mostly move together, and trades in stocks mostly win and lose together. If you buy four names and short four at the same time, there’s a pretty good chance that one set four is going to make money and one will lose money. Anything we can do, as technical traders, to loosen the bonds of correlation (or, in more quantitative terms, to reduce the beta of a trade) in our pattern analysis is useful.

Logically, stocks will become less correlated to the market when something company-specific is driving changes in the stock price. In the absence of those company-specific factors, most stocks will more or less drift with the market. There are a handful of patterns, all tied together by urgency (expressed in different ways), that can give an edge to a pattern playing out with less market influence than would otherwise be expected.

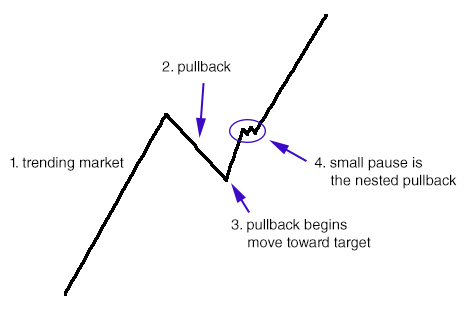

One of these is a pattern that I called a “nested pullback” in my book; the pattern occurs when a pattern is “in force” and is moving toward a target. That move makes a pause of a few bars (on your trading timeframe), and this pause is the nested pullback. It is a way to incorporate multiple timeframe influences without explicitly pulling up a higher timeframe chart; the higher timeframe momentum is “in force”, and we are simply looking for a lower timeframe inflection in that momentum. Schematically and conceptually, this is the trade:

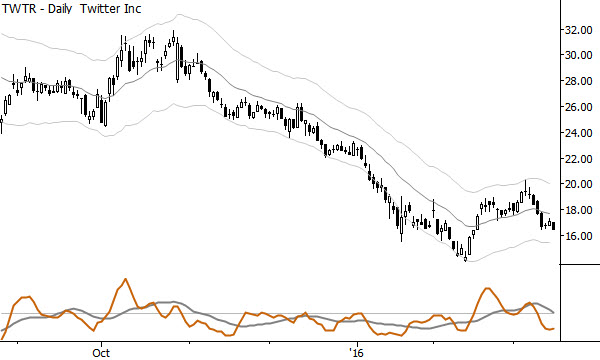

Now, consider this idea in the current chart of TWTR:

It’s easy to see that the 2nd and 3rd bars from the right of the chart may be a pause in the breakdown that started in the high teens. Though this is a daily chart, the price structure is a complex (two-legged) pullback on the weekly timeframe, so this daily pause is essentially a tiny pullback within the context of that big weekly structure.

What do you do with this information? Well, as always the answer depends on who you are as a trader and how you make trading decisions. This is not an example from a carefully selected trade that worked out. I’m showing you a live trade (that may look silly by the time you read this months down the road), but we had already identified a short setup in this name. In fact, in the research I write for Waverly Advisors, we published a short entry on TWTR before the open of 3/7. If you were on board the breakdown from that point, there’s little to do here except to identify the pattern and watch what happens. Critically, the action out of this pattern–whether it leads to clean breakdown (confirmation of the trade) or not (possible contradiction) can give insight into the character of the move and to the conviction behind the move.

Many traders will be attracted to the idea of using a little pattern like this to finesse an entry into the weekly trade with tight stops. Conceptually, this is possible, but it’s more difficult in practice. One of the biggest mistakes discretionary traders make is using stops that are too tight, and then their stops simply become targets in a noisy market. If you’re going to do this, make sure you understand the tradeoffs between tight stops and probabilities.

One last point: this is an example of a pattern that is fairly “easy” for the human trader to handle, but that is very difficult to quantify. You could write code to describe a nested pullback, but that code would take a lot of tweaking and refining before it worked well. (We’d have to define the initial move, what setups are valid, how much momentum would set up the nested pullback, the scope and location of the pullback, and we’d have to strike a balance in all of this between precision and leaving a wide enough range that we catch all the patterns we want–not an easy task!) This is a pattern that puts the human skill of pattern recognition to work in a disciplined framework, and points us toward a type of trading in which discretionary and quantitative tools can work together.

I’ve written about this pattern before, and even have a section on my blog dedicated to it. Why do I write about the same patterns over and over? Because focusing on a defined subset of patterns can lead to great understanding of complex and complicated markets. Because these patterns work. Because they are important.

With this pattern, would it be wise to use options?

Let say your profit target and stop loss have the same distance to your entry price. Then, for a long entry, a option with a strike above the stock entry price, the price change of the option is higher for when the profit target is hit then for when the stop loss price is hit due to the increase of the gamma of the option? So you will have more upside than downside, however the distance underlying is the same.

Disregarded the spread on options of individual stocks.

What do you think?

In general, if you have a directional bias then it can make sense to use options. With this pattern you might also have some attractive contraction in implieds as the market sits in the second little pullback… a nice little boost to your edge buying options in these types of patterns.

Good thought!

Great insight as always! I had a question regarding the tight stops that you mentioned in the article. As a trader I am still trying to figure out if I should put on a real-time stop loss or put it at the close of the bar. I’ve lost quite a bit by being stopped out by a tail then price just reversing all the way back. Your input would be greatly appreciated. Thank you.