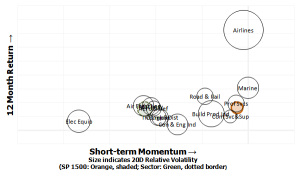

Industrials are running into some trouble. This could be significant for the broad market, or it could be noisy sector rotation. (I’d bet on the latter, at this point.) Here’s a (admittedly crowded) chart that shows how important Airlines are within the sector. Seeing Airlines falter, or, rather, fail to recover, would likely be very bad for the sector. (Click to enlarge, and see this post for more information on the concept behind the graphic.)

If you’re involved in financial markets, uncertainty and probability should occupy a good deal of your thinking, and thinking about how we think about uncertainly might also be useful.

As for this morning’s huge GDP increase, Ryan Detrick says what probably needs to be said: “Tough to conclude much here other than the economy continues to improve, even as the Fed slows QE.” A little more detail here, from Calculated Risk.

Brett Steenbarger expanded my post from last week on the Rage to Master with some good additional thoughts. He always has a way to simply the complex to key elements, and this post, on the essence of a trading process, is worth your time.

And for a few non-finance reads: This post, on the importance of error in scientific progress, is interesting, and Lifehacker is always good with simple things I probably should know, but probably don’t.