Systematic traders have a perennial debate: how much or how little to intervene in your system’s rules? There are a range of acceptable solutions, but the key is to be very consistent. If you will fiddle, then fiddle, but if you say you are a purely systematic trader, then you are obligated to be a purely systematic trader always, on every trade.

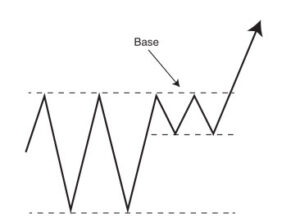

One of our systems is a long-term trend following system based on a channel breakout. Over a decent sample of trades, the performance is strong and stable, but it is the type of system that has many frequent whipsaws. Trend following has gotten a lot of press in the past decade, and many people advocate it as the only way to trade. (That is, of course, not true—there are many effective ways to trade.) Many people want to be trend followers, but they do not realize how difficult it can be, particularly for some traders/managers with certain personality traits.

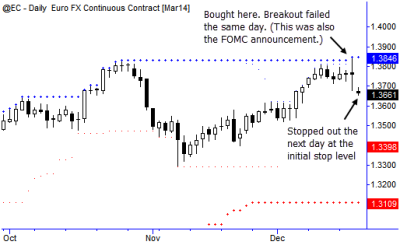

Look at the trade above. This is nearly a worst case scenario: enter yesterday, stopped out this morning. Boom. Done. If you trade a system like this, you have to be able to take a trade like this, take the loss the next day, and then move on with no emotional involvement. Not every trader can do this, but this is an essential skill for a trend follower.

Another thought: you may look at this trade and say that, of course, it was silly to take a position in the EURUSD ahead of the FOMC announcement, or that the entry was only “ticked” in and adding layers of confirmation would have avoided a losing trade. Just be careful of hindsight bias—if this trade had resolved differently you might be hailing the genius of a simple breakout system. Losing trades, within the context of a set of system rules that have a strong edge, should not bother us, but emotional mistakes are devastating. Cultivate clarity and ability to respond decisively to whatever the market can throw your way.