This past weekend, I hosted the first of The Hudson Sessions—a series of twelve talks, each focusing on topics drawn from a chapter of my first book, The Art and Science of Technical Analysis. The session was a resounding success, providing valuable information and fostering engaging discussions. Here’s a taste of what we covered.

The Quest for Meaning

The session began with a discussion of motivations and reasons for trading. While financial reward is an obvious incentive, I delved into the deeper aspects of trading, such as the quest for meaning and the importance of living a life with direction.

We then proceeded to cover major topics from the first chapter, including edge, expectancy, chart reading, market patterns, pivot points, and the significance of doing work by hand. I also shared my personal struggles with adapting to a new type of trading after nearly 20 years—walking the walk, not just talking the talk here!

A key focus of the session was setting realistic expectations for trading success. I urged attendees to avoid starting with the goal of making a living from trading. Instead, I suggested honing their trading skills and mastering the craft—focusing on process, rather than goal. We explored the concept of growing a small account into a more significant one, emphasizing patience, discipline, and the right approach.

We also addressed the role of volume in trading. While I mentioned that it’s not useful for my personal process and challenged conventional thought on the topic, I acknowledged its usefulness for some traders. The main takeaway was the importance of understanding what works best for each individual trader and focusing on the core aspects that genuinely make a difference.

Bruce Lee’s maxim, “Absorb what is useful. Reject what is useless. Add what is essentially your own,” has guided my trading philosophy in recent years, and I was glad to share this wisdom during the session.

A Never-Before Seen Visualization

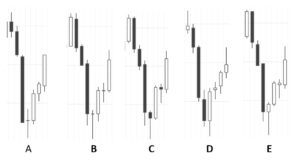

I introduced a new visualization, which involves “offsetting” price bars arbitrary amounts, essentially asking, “What if the timestamps were just a few seconds later?” This work has profound implications for understanding what patterns on charts truly represent, helping traders avoid the common pitfall of confusing the map for the territory.

A central theme of the talk was the importance of focusing on the process rather than outcomes. I introduced the concept of “trading beautifully,” which emphasizes minimizing errors, capitalizing on the right moves when opportunities arise, and reducing unforced errors. Trading beautifully doesn’t guarantee that every trade will be successful, but it does ensure that you consistently act with clarity, integrity, and power as a trader.

I also emphasized the need for adaptability and openness to new ideas in trading. I encouraged attendees to experiment with various time frames, remain flexible with their trading methods, and stay informed about new technologies and advancements in the field, such as artificial intelligence (AI).

Throughout the session, I underscored the importance of continuous learning, growth, and adaptation as a trader. This includes researching new ideas and theories, evaluating trades, and conducting thorough analysis. I stressed that to succeed in trading, it’s crucial to make the process your own and develop a deep understanding of the market.

I’ll See You at the Next Session!

Thank you to all participants for your time and attention, and for providing feedback on the talk. I’m happy you were able to join us, and I hope to see you in future sessions, where we’ll continue to explore the fascinating world of trading and share valuable insights to help you succeed in this challenging field.

Session one is available for replay here. I look forward to seeing you in session two, which will be held next week. Register here, read chapter two of the book, and join us for another exciting session! Trust me, you won’t want to miss it!