suncolored asked, in response to my Simply, simplify, simplify post:

Any real backtest proving you’re right ??

First of all, I’d respectfully suggest you may be asking the wrong question; I think you have the right idea, but perhaps this is going about it in the wrong way. My concern is that most backtests aren’t worth the time it takes to read them. It is so easy to make mistakes that invalidate a backtest or make it misleading, whether intentionally or accidentally. You should never trust a backtest unless you know the details of how it was done, and you have the statistical background to understand it. Many people will offer you tons of backtests, but they usually prove nothing.

Second, even if there are backtests of my ideas (there are), the real question is, can I communicate the ideas to you, the reader, in a way that makes them useful to you? I could have the best trading system in the world, but if I cannot somehow transmit the information to you, we’re both wasting our time. I spent many hours on the book, and am testing a few more ways to teach even more effectively, but there’s still that question you should be asking: “can I really learn from this guy? Will what he has to teach mesh with my style and worldview?” Judging from the reviews on Amazon of the book and the notes I’ve gotten in my emails, many people are having a very positive experience with the book, but that’s a critical question you should ask.

I just mention those points because if I had known them many years ago I could’ve saved myself tens of thousands of dollars, countless hours, and so much frustration as I was learning to trade and exploring new styles. Now, if you’re really asking about backtests, the answer is yes. The first version of the book I submitted to Wiley was over 900 pages. I ended up cutting about half of that from the final copy. What was cut was a few chapters on quantitative methods applied to market data, and a very long chapter including a deep investigation of tools such as Fibonacci ratios, moving averages and some other technical tools, with the idea of showing, in practice, how backtests can be structured to understand how the market really moves. (I have what I consider fairly conclusive proof that these things do not have an edge, but that’s material for a future series of posts perhaps.)

One of the things that is a little unusual about me is that I’m a discretionary trader, but I have also done a lot of deep, statistical research on market patterns. In fact, I’m a statistics junkie. In the past, I have studied my trading patterns and tendencies across all markets and in many different time periods, even going back to Equities in the 1700-1800s, grain prices in Europe in the 1300’s, and, perhaps to the point of absurdity, to the price of dates and barley in ancient Babylon! I refreshed much of this research for the book, and generated over a gigabyte of numerical output in the process. Not video or audio—1 gigabyte of csv numbers. There were also over 100 pages of tables of statistical tendencies in the first edition of the book, but these were cut from the final copy. So, yes, there are extensive backtests that support my idea of how markets work, but, like any theory, I don’t think it’s possible to “prove” that I’m “right”. Learn what you can from my blog, ask questions, if things seem like a fit maybe check out the book. I also publish a daily research note with Waverly Advisors so you can see my trade recommendations (albeit in a recommendation, not an actual trading format) in real time. That’s not a trading record, but there will be a very public way (i.e., a mutual fund) for you to follow my actual trading in real time soon too. Anyway, I hope you’ll find something of value in my perspective, but, if not, there are many other authors and many other approaches out there. It really has to resonate with you for it to be valuable to you.

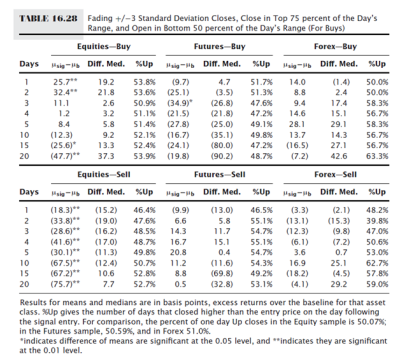

Just for fun, here is one of the tables from the book. There were well over a hundred of these, but here you can see quantitative proof of the difference in mean reversion across asset classes. Maybe I’ll share some more work like this in the future, if there’s an appetite for it here.