Cryptocurrencies are in focus recently. Bitcoin has fallen almost 50% from its peak, and the future seems far less certain than it did a year ago. We were able to identify the shift in market dynamics early on, and I want to show you how we did it.

Narrative and drivers

I guess I should spend a few words here admitting that I never quite “got” the crypto story. I saw the potential in blockchain technology but felt that it was being vastly overstated when people discussed it. It seemed to me more of a small but meaningful advance, while many people were treating it as something more akin to the discovery of fire.

Fine. A lot of people who are probably both smarter and better educated on this topic disagreed with my opinion—and that’s a combination you have to respect! When you find yourself on the wrong side of an argument like that, perhaps it’s best not to press that argument too hard.

I do think we are probably spinning toward a cryptographic apocalypse, at least if quantum computing lives up to a fraction of what seems to be the potential. We really could wake up one morning and discover that all the encryption in the world is broken… so there’s that to consider.

There’s also the fact that many (not all) of the loudest and shrillest advocates for cryptocurrencies seem to not understand anything at all. There are crazy embedded neo-Marxist narratives, anti-Fed rants, and just general silliness. Many of the people who had some success with these things just got lucky by buying early on (and more power to them… maybe they saw something the rest of us missed), but this kind of luck does not translate to insight.

Volatility is the challenge

All markets are, arguably, confidence schemes on some level—things are worth what we agree they are worth, and someone is going to be the last one standing when the music stops. But it’s been hard to see much of the narrative as anything other than an effort to prop coins up, much like we have seen with other assets when they reach valuations disconnected from reality.

I have never seen the potential in the current crop of coins as either a store of value or a medium of exchange. I realize Paul Tudor Jones has recently and vocally said the opposite—that bitcoin is an inflation hedge and a solid store of value, but, unless I’m missing something, this is nonsense. Given the volatility of these things, it’s hard to imagine paying your rent with something that could be worth 50% more or less next week than it is today.

I guess the key takeaway here is that I’ve had a fundamentally bearish bias, all the while many of these coins have seen eye-watering gains in the thousands of percents. So what do you do? If you’re a disciplined trader, you focus on the price action and ignore your fundamental reservations. After all, my repeated caveat of “unless I’m missing something” is not just an empty phrase—perhaps I really am missing something.

Regime shift

One of the oft-repeated ideas here is that cryptos offer diversification of risk. In other words, own your stocks, and cryptocurrency can be a nice, uncorrelated hedge.

Several recent papers have examined this idea, with the conclusion that the volatility of these instruments destroys their value as a hedge. Furthermore, whatever value they did have was driven by their stratospheric returns, meaning they brought meaningful juice to a portfolio even in a very small allocation. (This paper is a good read, but you certainly can find others.)

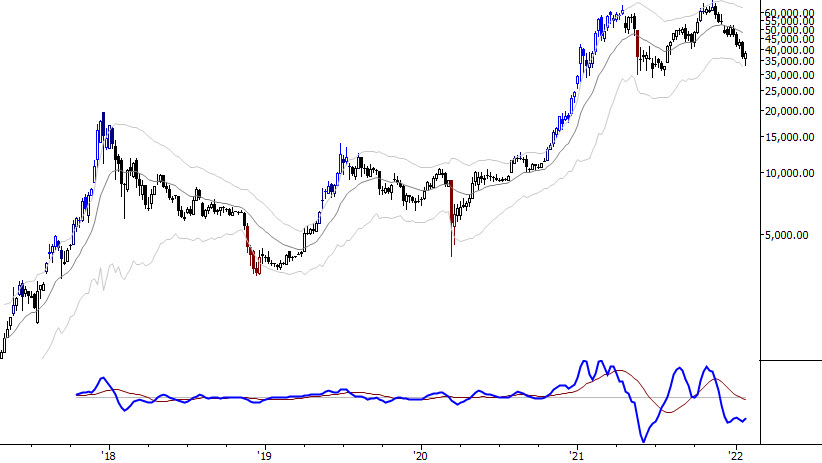

Sometimes, watching price action can give us insight that eludes the researchers. We saw, with crystal clarity, that the behavior of bitcoin shifted immediately following the early 2020 Covid-driven stock selloff. When stocks recovered, bitcoin fell into step with stocks and this has not changed.

I’ve repeatedly told our MarketLife members that cryptos are trading “as a risk asset”. (Here’s a lagniappe for persevering this far in this post: there seems to be a leading relationship between stocks and cryptos—stocks have led at many of the key turns. It should not be too hard to find something to do with that…)

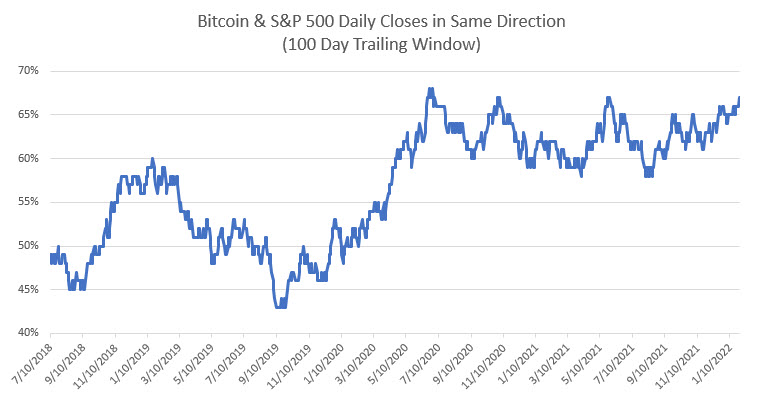

Here’s a quick verification of that regime shift. The chart below shows the percentage of the past 100 trading days on which the S&P 500 and Bitcoin have closed in the same direction. It’s a bit subtle, but it’s also real: pre-2020, the relationship hovered around 50%. After the Covid rally, about 63% of the days see a close in the same direction.

This is a quick and dirty way to look at the relationship, but it does point out a shift, and we think this shift is important. Of course, the real question is what happens next, and we’ll be watching this relationship closely in coming months.