Sometimes I think the world probably does not want to see yet another blog from me illustrating yet another basic pattern… but these “basic patterns” can be wildly profitable. You can build your entire trading career around this one, simple pattern.

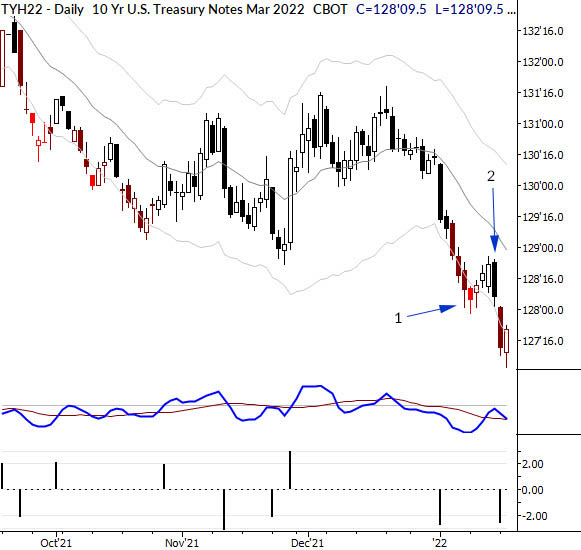

The attached chart shows a recent pullback in 10 Year Treasury Note future that we called in our Talon Advisors report. (This report is now completely free. You can sign up here.)

There are many possible lessons to extract from this one chart:

- A pattern on the daily acting as a nested pattern in the weekly

- The emergence of new downside momentum

- Multiple upside failures leading to a better downside move

- The principle that new momentum generally (with a statistically and economically meaningful edge) precedes new price extremes in the same direction.

- The importance of waiting for clear patterns and setups before taking a trade. (You could have lost a lot of money on sub-optimal setups in this market over the past few months.)

- And the power of a simple flag.

Let’s focus on that last one, and just highlight the textbook steps that set up this pattern:

At 1) we see the market has broken down with good momentum. At least three things on the chart confirm: price has touched the lower Keltner Channel; the MACD has made a new low, relative to its recent history; and critical support has broken.

Following this action, leading up to 2), the market began what we might describe as “a reluctant bounce”. No strong upside momentum developed, and the bounce failed to correct much (more than 50%) of the previous selloff.

Once you see the flag form, you can look to enter on downside momentum. There are many possibilities for precise entries, but the bar marked 2) is a textbook short entry.

One more thing: we’ve been doing more and more work taking profits at 1R. Yes, this flies in the face of what every internet guru would like you to believe… I know you’ve heard nothing but being sure you have 5X your risk as potential reward, but this is a clear path to consistency and to flattening the drawdowns in your equity curve.

This is, by far, the most powerful trading pattern I know. Nothing else—candlesticks, indicators, Fibonacci ratios—nothing else comes close. If these patterns aren’t already a part of your trading, they probably should be!