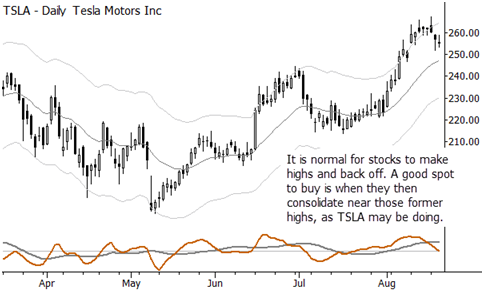

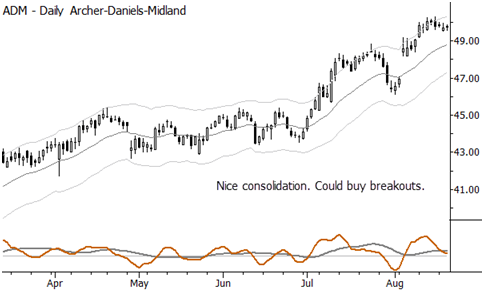

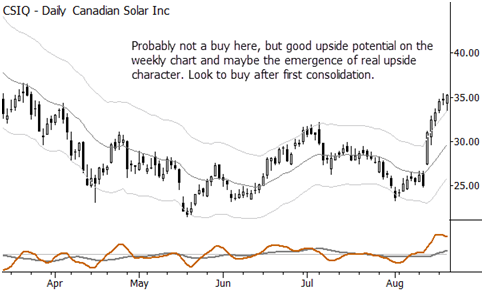

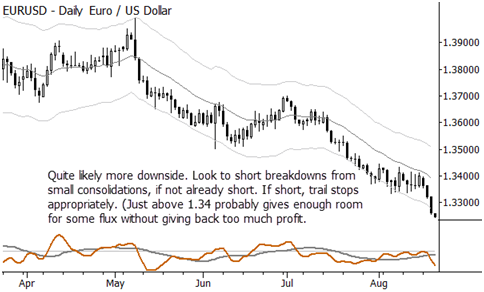

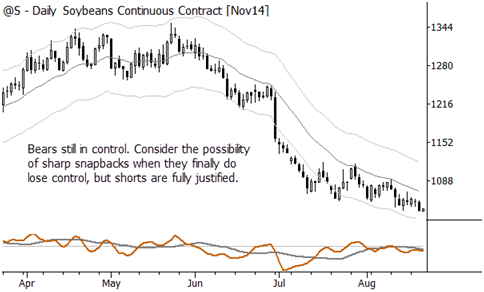

Here are a few trading ideas. Some may be immediately executable; some may need to go on a watchlist. In most cases, these are consolidation plays and could be entered on short term breakouts (e.g., breakout of previous day’s high, if looking to buy). There’s a little bit of everything: individual stocks, a currency, an index short, and a commodity, and a mix of long/short ideas. Last, profit taking is important. These are swing trades, so don’t extrapolate into multi-month moves. When those develop and we’re lucky to be on board (as we have been for beans and the euro), that’s great and a trailing stop will keep you in the trade, but that is not the expectation here. Correct stops, proper risk management, correct position sizes based on risk, disciplined profit-taking, and trailing stops are your friends.

Hi Mr. Grimes. In relation to your “Some challenges for technical analysis” article, can you give an example of how you would test the patterns in prices in these setups you listed? Thank you

I have already given some examples here and in the course, but I will certainly be going deeper into this topic in the coming months. Good question, and the answer is yes. 🙂