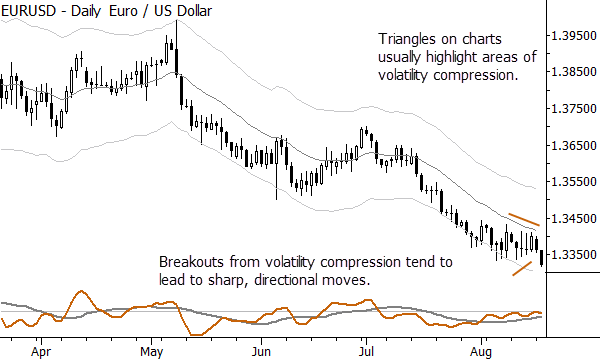

I have written before about volatility compression, which is the tendency for markets to make cleaner, more directional moves after the volatility has contracted on the same timeframe. Triangles and/or inside bars often mark areas of volatility compression; this is one way that a simple chart pattern can point to something that is quantitatively significant. The EURUSD (and also the USD index, of course, since the euro is more than 80% of the USD index basket) has undergone a period of volatility compression, and may be making a breakout that could lead to a clean directional move. My research clients have seen that we have been short the EURUSD since 7/15/14, and now hold that short with a stop below our entry price. Regardless, the pattern is valid and today may mark a potential entry for some swing traders on the daily timeframe. As always, risk management and trade management decisions are far more important than your entry point, but it doesn’t hurt to have an entry point with an edge too!

Possible breakout in the euro

- Post author:AdamHGrimes

- Post published:08/19/2014

- Post category:Breakout / Chart of the Day

AdamHGrimes

Adam Grimes has over two decades of experience in the industry as a trader, analyst and system developer. The author of a best-selling trading book, he has traded for his own account, for a top prop firm, and spent several years at the New York Mercantile Exchange. He focuses on the intersection of quantitative analysis and discretionary trading, and has a talent for teaching and helping traders find their own way in the market.