Over the years, I’ve moved toward being increasingly skeptical and critical of trading ideas. I knew this was happening, even if it was not a deliberate choice, but a recent podcast I did make me question my reasons for being so skeptical, and reaffirmed the value of the approach.

Up front, we need to realize that being highly skeptical of trading ideas is not without cost. It is true that there are many ways to make money in the market–two people can look at a market, one can short and one can buy, and they can both make money. We can see markets on different timeframes. We can look at different technical factors. We can focus on valuation or competitive advantage. There are literally thousands of ways we can trade.

Also, in today’s ever-more-interconnected world, isn’t there a social advantage to being accepting of new ideas? Why would we choose to default to criticizing someone’s approach, or to assuming the tools they are using do not work? Is this really the best way to be a global citizen? Does this make sense?

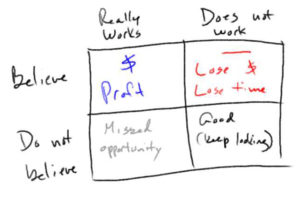

Yes, it does, and here’s why. Take a look at the grid below, on which we can place any trading idea or method. We evaluate it based on two criteria:

- the idea “works” or it “does not work.”

- I believe the idea works or I do not believe it works.

Granted, each of these concepts is deep and complex in itself–if we want to know if something works we immediately find ourselves in complexities of statistical tests, transaction costs, and with very important questions of practical applications. For now, for this discussion, let’s just make all of those go away and assume that, at its core, an idea is either valid (it works) or it is not.

Consider each quadrant of the graph:

- If the idea Really Works and I Believe it works, I make money. Cha-ching. Profit. This is where we want to be. In fact, this is the only place on that box we want to be.

- Conversely, if the idea Does Not Work but I Believe, I lose. I lose money and time, and possibly take an emotional beating. (This aspect of emotional capital is very real; don’t underestimate its importance.) We absolutely do not want to be in this quadrant, and we better not stay here for long. Over the course of a trading career, we’ll venture into this territory, but its costly and painful and much of our work is designed to get us out and keep us out.

- If the idea Does Not Work and I Do Not Believe it works, this is another good place to be. I will keep looking. This is where we spend a lot of our research and development time, and this is a box in which true learning can take place. No, we don’t make money. Yes, there’s a cost of time and possibly emotional capital, but there are also benefits here. While this is not our goal and destination, it’s not a bad place to be at all.

- If the idea Really Works and I Do Not Believe it works, I have missed some opportunity be rejecting a valid idea. I could have made money with it, and I possibly could have learned something from it that might have sparked other ideas. It’s also possible I learned something that was false in this box. However, all of this costs much less than losing time and money.

You have to accept some consequences, and your personal evaluation may be different than mine. Perhaps you’re willing to lose a lot of money on ideas that don’t work because you want to make sure you accept every idea that does work. (For the record, I think that’s the height of silliness, but someone might feel differently!) For me, the search for truth takes a back seat to the search for profits; it’s still important, but I’d rather reject valid ideas than accept invalid ideas into my process.

One last thought: I have come to believe there are many more ways that do not work in trading than there are ways that work. All you have to do is go through some internet trading groups and look at the proliferation of half-baked trading ideas/methods put together by traders who are not profitable, but then presented to other traders as models of how to trade. Given any trading idea, there’s a much better chance that it does not work than it works. Much better! (Yes, the ways that do work are valuable enough to make the E() calculation for the effort involved in finding valid ideas positive…) So, this is yet another reason why I’ve chosen to default to “does not work” as a key part of my perspective on trading.

It’s always a good idea to evaluate our own mental processes and biases. Doing so can sometimes reaffirm what we do (as this has for me), or it can show us things to do differently, better. At the very least, a mind well-examined is maybe a little less vulnerable to errors and casual mistakes.