Today, I want to write a bit about the value of keeping charts by hand. I’ve written on this topic before, but I think it is so important it’s worth another reminder here. Though it is time consuming and is probably one of the oldest of the “old school” practices, I have found great value in keeping price charts by hand. In fact, it is the single most useful practice I know of to help a trader really learn how to read and understand price charts.

When I started trading, I didn’t use a chart service or a computer program. I was figuring everything out from scratch, and didn’t even really know what kinds of chart services might have helped me or where to find them. Instead, I had a newspaper and graph paper and every day I would add one price bar to my charts for coffee, sugar, grains, meats and metal futures, and I actually spent time in a library going back through old issues to find historical data to build older charts. This was incredibly time consuming, to say the least. After doing this for a while, I did eventually get a charting service, but I am sure those first few months of charting by hand laid the foundation for understanding the action behind the charts.

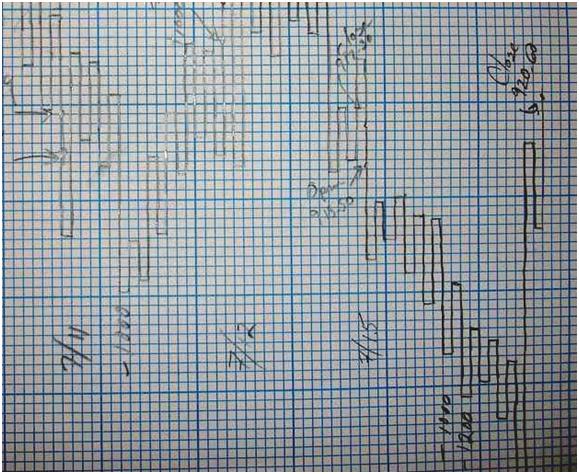

Several years later, I found myself struggling a bit as I made transitions to new products and new timeframes. One of the best suggestions I received was to take a step back and start keeping a five-minute swing chart of the S&P 500 futures by hand every day, and so it began. For the next year and a half, I graphed every single move of the market by hand. This required complete focus, and, most importantly, I had to be sitting at the desk every minute the market was open paying attention to prices on the screen. What began on a single piece of graph paper grew, after much taping and stapling, into a leviathan that coiled around the walls of my home office, and had cuts where the door was so it was possible to enter and exit the room. (It helps to have an understanding family if you are going to try a stunt like this!)

There are many ways to do this practice (and I’ve written about a few of them in blogs and in my book). You can skip the charts and simply write down prices at specified intervals. In other words, if you’re a daytrader, maybe write down prices for 6 active stocks and the S&P 500 every 15 minutes throughout the day. Longer-term traders can write down end of day prices, maybe for major global stock indexes, bonds, gold, etc. Simply writing down prices has the benefit of pulling you away from charts. Many modern traders are probably too dependent on charts, and looking at raw prices forces you to think about the data differently. For most traders, this is really uncomfortable at first. Try it and see—the less you like it, the more you probably need to do it, at least for a while.

You also can keep full charts by hand. The specifics of how to do this don’t matter as much as having a consistent methodology for defining the swings. When I did this intraday, I was defining a swing as a move a certain percentage of intraday ATR off a swing high and low. So, for instance, once the market came off a high by a distance equal to 3 average bar ranges, I would draw a line on the chart and then wait for price to bounce three ranges off a low point to draw the next line. You can use a system like this, but there are many other options. It is just as useful to keep simple bar charts or point and figure charts.

Why in the world would anyone do this? Well, first of all, electronic charts may make life too easy. It’s too easy to look at thousands of price bars a day on your screen and simply accept them for what they are, scanning for heads and shoulders or whatever pattern you want to give a shot this week. Pretty soon, your eyes just glaze over. Drawing lines by hand forces you to think about the buying and selling that is behind each move in the market. The act of picking up a pencil engages a different part of the brain and makes learning faster and more complete. This makes you pay attention in a deep, almost Zen, sense of the word. It is not enough that you are at your desk. You must really focus and be in the moment while you are trading. Keeping charts by hand encourages this state and enforces the kind of discipline needed for top-notch trading.

I am not saying this is the solution to all your trading problems, but I believe doing this taught me to read charts better than anything else I have done. At the very least, it’s a different perspective on the learning process and market acction—in the year 2014 you won’t hear many other people tell you to sit down at your computer and break out the graph paper!

Just to add : In addition to Drawing Intraday swing Hand chart…. I summarise the intraday hand chart with a Chart Session Story in terms of ongoing Bulls & Bears Battle to my Intraday swing Hand chart (Details as explained in course Week 2 – Part 2 Chart reading skill Homework)….. Do watch it ..It may help !