A week ago, I pointed out trade setups in NZDUSD and many NZD crosses to my MarketLife and Talon clients.

Of course, one issue currency traders need to consider is correlated risk; if you take a bunch of trades driven by one particular currency (even if that currency is the USD!), you don’t really have “a bunch” of trades–you really have one big trade and one big basket of correlated risk. Those trades are likely to succeed or fail at the same time.

So that’s a concern, but the lesson here, a week later, is why we were so focused on the NZD. The answer is simple: market structure.

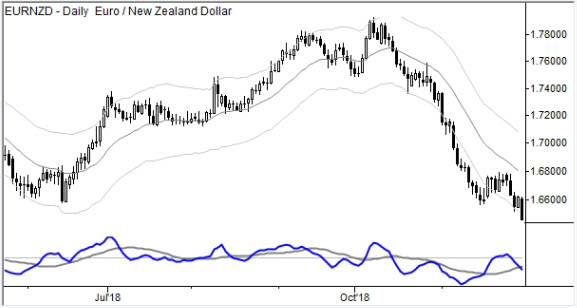

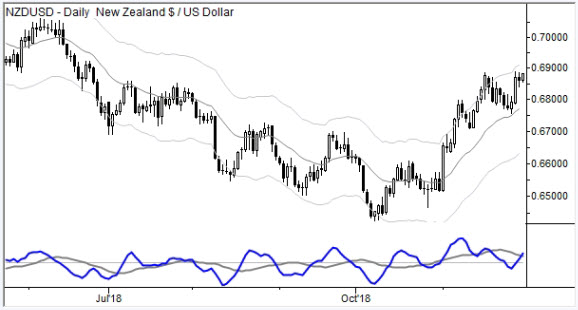

Take a look at the charts below, and see if you can see what I was looking at five days ago:

These simple flag patterns work. In a world where everyone is worried about HFTs, AI, and markets generally becoming untradable, this simple pattern continues to point the way to profitable trades–year after year.

I’ve built a career around this pattern. You can do. It’s a major focus of my extensive, free trading course–start there and see what a difference an intimate understanding of this powerful pattern can do for your trading.