Why I'm not worried about a recession (yet)

Investors are terrified at the thought of a recession. (Writers love it, because everyone will read an article on a recession!) Investors are right to be concerned, as bear markets in stocks have lined up nicely with recessions--investors have a tough time, and real value is destroyed in good companies.

It's appropriate that we spend some time understanding what a recession is, how (and if) they can be predicted, and, hopefully, to have some idea how to prepare ourselves for the future.

What is a recession?

A recession is broadly defined as a period during which economic activity declines. Journalists often use a simplistic definition of two consecutive quarters of declines in real (inflation-adjusted) GDP.

The NBER (National Bureau of Economic Research) is a bit more vague. Their definition is:

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. A recession begins just after the economy reaches a peak of activity and ends as the economy reaches its trough. Between trough and peak, the economy is in an expansion. Expansion is the normal state of the economy; most recessions are brief and they have been rare in recent decades.

The NBER definition matters, because most of the historical charts you've seen with the shaded areas indicating recession rely on the NBER's (not entirely clear) definition.

We can work with a rough understanding that a recession is a time during which the economy declines by most measures. (A depression is usually understood as a longer and more severe recession, though there's no precise definition.)

Are recessions predictable?

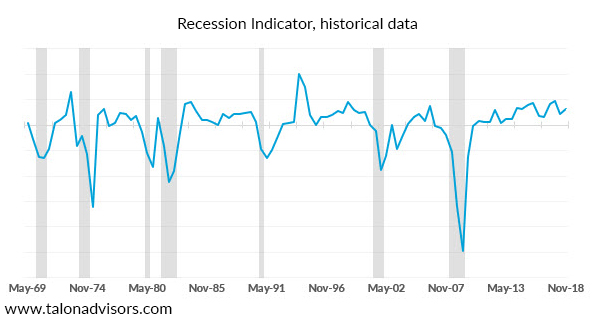

The good news is that recessions are predictable, within the bounds of probability. Take a look at the chart below, which is one of the recessionary probability models I've relied on for years. (This model has also kept me on the right side of the market for years!)

Though we don't disclose the details on the model, I can tell you it's made from publicly-available data, and has very few moving parts. (It's surprising how effective simple mathematical models can be.) Using this tool is simple: when the measure dips below the zero line, there's a very high probability of a recession just around the corner.

You can see the tool has a very solid record: it's predicted every recession since the 1960's by dipping below zero, well in advance. It also has never had a false signal! (Of course, it doesn't do quite as good of a job at pinpointing the end of a recession, but that's also not what it's designed to do!)

There are some nuances to using a tool like this. Most important is that the stock market leads economic data. By the time a recession has started, significant damage has been done to stocks. This is why technical tools matter, have why I've made the decision to be a technically-focused (but fundamentally-informed) trader/investor. (And, for the record, I think technical factors in stocks are flashing some fairly serious warning signals as of December 2018...)

It's also certainly possible that something could change in the economy that could break this indicator. Just because something has worked in the past, doesn't mean it will definitely work in the future. That's why it's best to use multiple tools and to understand them within a framework of probabilities and ever-shifting risk and opportunity.

This is one of the tools we use for my longer-term work at Talon Advisors. We publish daily and weekly reports, but also a quarterly deep-dive into macro factors and fundamentals. (To be perfectly honest, it's a very cool report. Tom and I both refer to our copies for reference multiple times each month, which I think says something--when you're producing research that's so good you are using it, you're probably doing something right!)

We'd love to have you check out my work at Talon. Start your FREE TRIAL today, and use the code TALONDEC18 for a 10% off your subscription.

This discount is only valid for a limited time, so go sign up today.