What's new with me and my work in 2020

I want to share some things Tom and I have been working on over the past year, and tell you about some exciting things that will be coming this year.

First, we’ve evolved MarketLife to the next stage in a pretty big way. The first thing you’ll notice is that the site got a big facelift, but it goes far beyond that—we’re sharing information in new ways, and have some completely new products, including a live trade room and a premarket piece that is one of the best in the business.

New trading focus and direction

Over the past decade, my work has been almost completely focused on “institutional” style trading. (This is a reflection of both my own experience trading size and advising many clients who are very large managers or traders.) What do I even mean by “ institutional ”?

- Prioritizing capital preservation over seeking aggressive returns

- In all cases, focusing on risk (drawdown, tail risk, etc.) over potential returns.

- This means accepting overall returns somewhere around 20% annually.

- Assuming the trader has a significant pool of capital and at least moderate sophistication

- Focusing on trades that are certainly longer than single day holds (no daytrading), and trading only markets that have adequate liquidity to move size without big market impact.

Now, I’d argue that 20% is about what one can expect to achieve under the best conditions with those constraints, and it’s on target with what the best large traders in the world achieve on average.

But, the reality is that many people learning to trade need to take a slightly different path. There are many people working with smaller accounts—when I started, I started with small accounts that were just a few thousand dollars (and promptly blew most of them, but that’s another story!).

It’s not too hard to see that we’re living in a time period where everyone is doing a “small account challenge” or something… trading tiny accounts, hoping to get lucky, and then posting the track record that shows gigantic gains. Of course, I’m suspicious and jaded about any groupthink and most marketing, but I think this also points to a weakness in my work to date: we've been too exclusively focused on the experience of the large trader.

So here’s what is changing for Tom and me:

- We are actually trading some very small accounts, and our MarketLife work will reflect what is possible (in terms of multiple positions, etc.) with those accounts.

- Personally, I’ve returned to a focus on short-term trading some futures. This is a kind of trading I have not done with any real focus in over 10 years, but it is, in fact, the foundation of who I am as a trader. I’ll write more about this soon.

- We are focusing heavily on options. For small accounts, options offer opportunities that you can’t get any other way.

- We're much more open to extremely aggressive risk in these small accounts. As long as people understand the tradeoff (which is that the "risk of ruin" becomes higher), there's nothing wrong for swinging for fences with a smaller account.

Life outside of markets, and spirituality

We named the company MarketLife, and that wasn’t an accident. The idea behind that name, which I don’t think we’ve been able to express very well (yet )was that long-term, consistent success only comes to the trader who figures out how trading fits into who he or she is and how it fits into his or her life. Doesn’t mean your life is consumed by trading; in fact, we’re saying the exact opposite: everything needs to be coherent, in its right place, and with the right focus.

So far, we've been very focused on the "market" side of the equation: we've created top notch scanning tools, we find the best trade setups, and we do a good job teaching people how to manage trades and trading. But we haven't gone very deeply into the "life" part...

Much of 2019 was a time of personal renewal for me, and I found myself drawn to ideas that I could best characterize as “spiritual”. Synchronicity aligned when, without dropping any hint of this shift in my thinking, I started to get carpet bombed with questions about the topic from friends and traders who I was mentoring! Other things aligned to support this, including my surprise when I learned Brett Steenbarger had written a book on the topic.

To be perfectly, brutally honest, this topic scares me. My work has focused heavily on what we can quantify. I’m essentially a quant dressed as a discretionary trader, and I absolutely abhor woo-woo and “magical thinking”—I’ve certainly ranted against the mathematical illiteracy of, for instance, the Fibonacci crowd many times in the past.

But, having said all that, there’s “a there there”. There’s something that goes beyond behavior and cognition (both of which are pivotal topics for traders, of course). At the very least, there’s a way we can trade and interact with the market that nourishes the whole person, and there’s a way we can do it that is ultimately profoundly harmful. This isn’t about success as a trader. In fact, you can have either of those outcomes—nourishing or destroying—while you are making or losing money.

But one thing I’ve quite sure of is that if you’re going to do “this” for any length of time, and if it’s going to be a significant part of your financial picture, you better do it in a way that is sustainable and makes you somehow more than what you’d be without it.

So, you can expect me to focus on that topic more this year. As I said, I don’t know exactly what that will look like, and it’s a topic that kinda scares me… but living on that “growing edge” is a good thing!

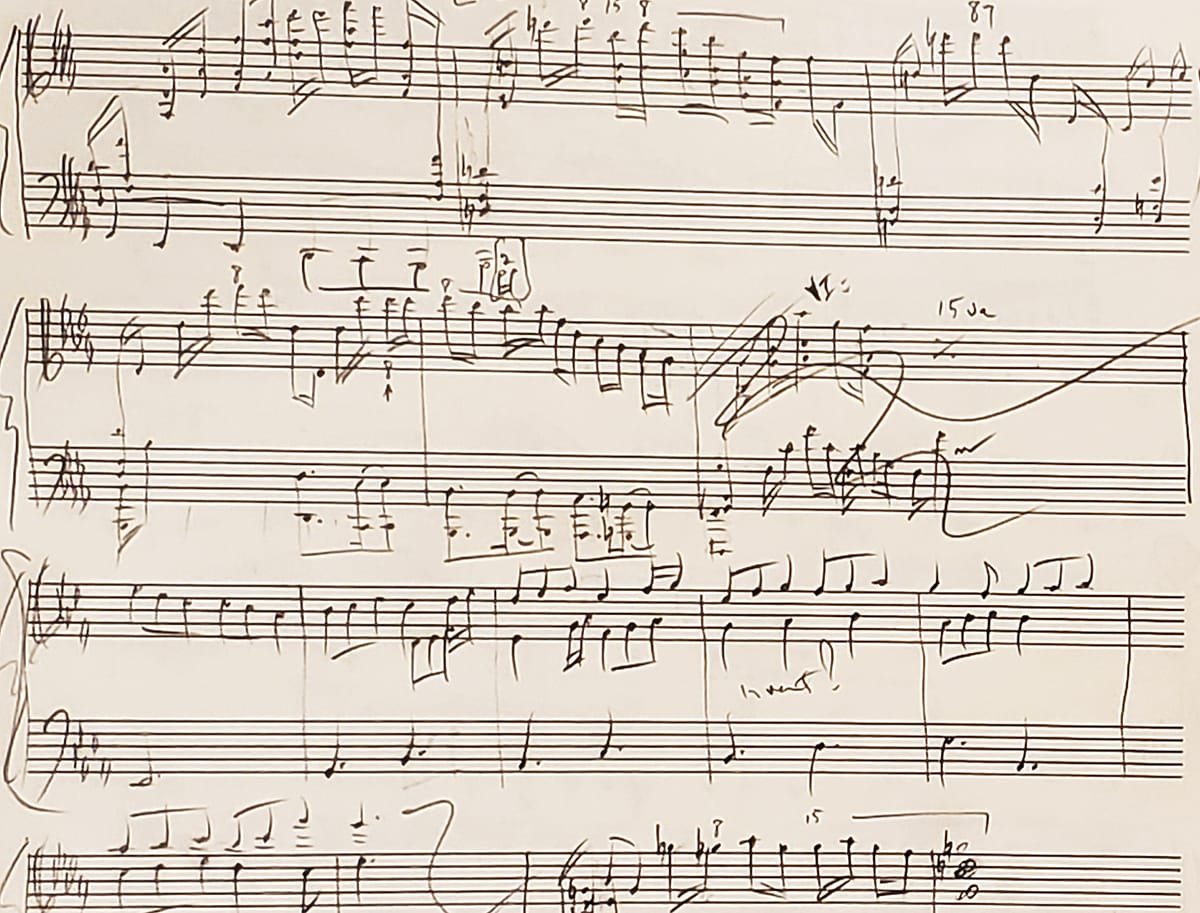

On a very non-market-related and personal note, I’ve returned to composing music seriously. You’ll be able see some of my work on my YouTube channel, and, in the near future, in other places. (You might even discover me blogging on the topics of composition and modern classical music somewhere else...) As I’ve gone deeply into this creative work, I’ve also seen many more connections with trading, markets, and teaching trading. I’ll share some of those insights here soon.