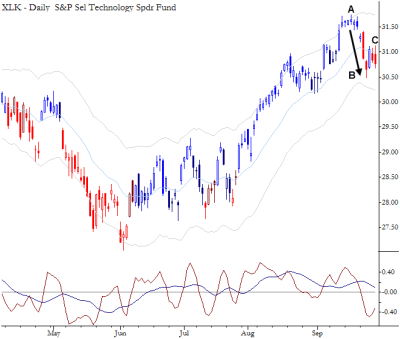

There is a clear bearish Anti setup in the Technology Sector SPDR (NYSE: XLK.) Linda Raschke first wrote about this pattern, and created the name for it. I have found it to be one of my most reliable trading patterns, and cover it in detail in The Art & Science of Technical Analysis. In this case, consider three parts to this setup: (A) A market in a strong uptrend makes a trend termination pattern. In this case, a small failure test above the channel (indicating slight potential exhaustion), but this pattern alone is nowhere near enough to justify a short, in my opinion. However at (B) a strong countertrend selloff develops, which is followed by a consolidation (C) near the lows of that downthrust. This setups up the potential for another leg down on a breakdown out of consolidation. Ideally, you want to enter on momentum below support, so many traders will have entered short in yesterday’s session. A further entry is possible today on weakness below yesterday’s low, with a stop somewhere in the high 31 area.

Note that this pattern can be useful in another way—a failure of this bearish pattern could result in a strong rally in the broad market. So, whether you intend to trade the short or not, it can be useful from a timing and monitoring perspective.

Adam,

saw this too, but wondered if a similar pattern in XLF might be even better. Reasons:

– potential “mini” blow off top prior to the decline

– Failure test of 2012 March high on weekly chart

– Stronger A-B decline

does anybody know where Adam went? been mighty quite here lately!