Ready to rumble? Is the US Dollar set for another breakout?

To trade or invest successfully, we have to think one step ahead of the market, but we have to discipline ourselves not to act early. We also must strike a balance between having a big picture perspective and being flexible as new information arrives--it helps to have a roadmap, but biases can be dangerous. The US Dollar has thrown some interesting curveballs recently, as an extended trend rolled over into a substantial pullback. Let's look at some of the lessons this market has taught us recently.

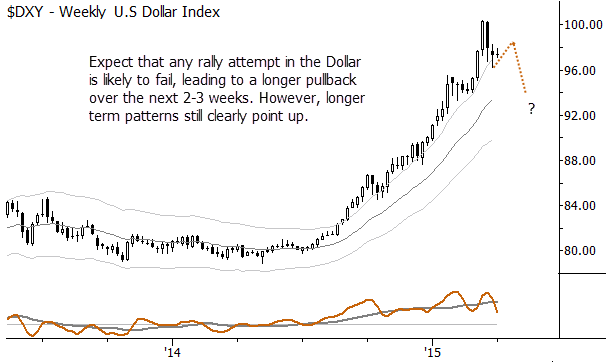

First, this has been my roadmap for the past several weeks. This is a chart that was published in research sent to my clients in which I outlined a plan for the next several weeks in the US Dollar. (Shameless plug here: I'm proud of the research product we produce and I would love to have you take a look at it. We offer of a free trial, and I schedule a phone call to speak personally and to discuss the research with anyone who takes that free trial.)

At that point, I saw a few critical issues with the Dollar:

- First, the trend is strong and intact. Looking for a reversal in the USD was (and still is) a sucker's game. There is quite likely more upside in the Dollar.

- We don't have to anticipate the end of the Dollar's trend; market structure and price will clearly signal that end when it comes.

- However, this is an overextended trend and the first rally attempt was likely to fail ((leading to a complex pullback)). Coming off of several months of "clean trending" currency trades, I was advising clients to expect the first rally in the Dollar to fail (it did) and not to buy into that rally.

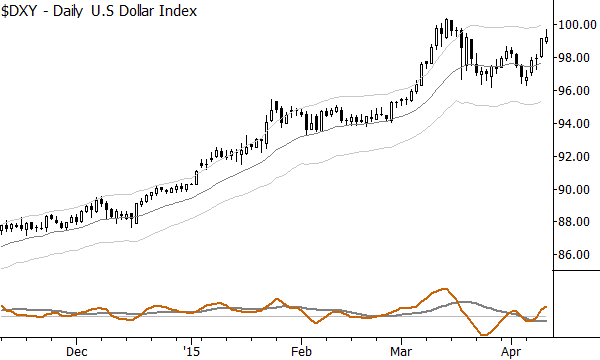

Here's how the trend developed a few weeks later:

So, the first rally attempt did fail, and any Dollar-motivated trades entered into that fake rally would have been losing trades. We were anticipating a deeper pullback, with potential into the low 90's, but this did not happen. Now the question we need to ask is: is this "enough" of a pullback? Could the Dollar be ready to rally from this point?

The answer is unclear, so now it comes down to position management and trading skill. The one that that is clear, at least to me, that there's more upside in the Dollar--tune out the anti-Dollar noise and focus on the message of market structure--but we have to be careful how we reach for that upside potential. The Dollar is at an inflection, and these points bring both danger and tremendous opportunity. The best way to play a market at an inflection is usually to take a position, but be quick to cut losses if the trade does not develop as expected, and this should be a pretty good plan for the Dollar over the next few weeks to months.