One of the critical questions traders must answer is how to reconcile conflicting information. If we are seeing markets clearly, there are always factors and arguments to be made for both directions.

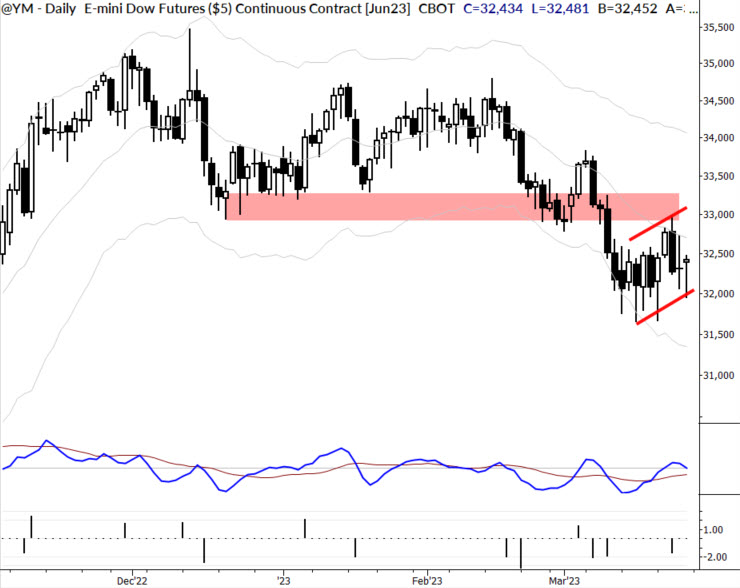

In the current market, we’ve seen enough selling pressure in recent weeks to break key support in indexes and to tilt the near-term probabilities to the downside. (See chart of the DJIA futures consolidating below a key support/resistance area.) However, intraday action has shown relatively strong buying pressure. (This shows on the daily chart as long lower “tails” on daily candles.)

How to reconcile this? We think it makes sense to retail flexibility to trade in either direction. We’ve had many great short entries on individual stocks in recent weeks, but have advised our MarketLife family members strong to consider taking profits at conservative levels on shorts, rather than playing for larger scale declines. We also suspect that some of the surprises may align to the upside, so we’re watching carefully for long entry triggers over the next two weeks.

The week ahead (potentially market-moving datapoints)

- Monday: None

- Tuesday: 8:30 Trade balance; 9:00 Case-Shiller HPI, FHFA Home price index’ 10:00 Consumer Confidence

- Wednesday: 10:00 Pending home sales

- Thursday: 8:30 GDP, Jobless Claims

- Friday: 8:30 Personal income & outlays, PCE; 10:00 Consumer sentiment