The most important thing you need to know about commodities

The marketplace is constantly evolving. One of the biggest changes over the past decade is the proliferation of Exchange Traded Products (ETPs) that allow stock traders to trade commodities (and other financial instruments) in a stock account. Much of the traded universe of financial products is now available just by punching up something that "looks like a stock ticker", but there are some important differences that can spell the difference between success and failure for a trader.

Probably the most important difference is that commodities tend to trend better than stocks. Another way to say the same thing is that stocks tend to mean revert more often and more strongly than commodities. If you have traded stocks for a while, you probably have a sense of when a move has gone far enough to be due for reversal, and you're probably used to seeing longer term positions more or less alternately green and red on the day over any reasonable stretch of time. Be careful, because these (correct) instincts will work against you in commodities, which can trend and trend and trend and end in blowoff moves that go far beyond what anyone expected. Simply put, if you come to commodities from a stock trading background, temper your urge to fade moves.

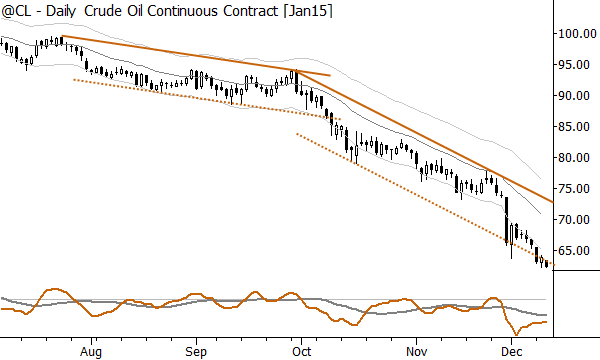

Much of the focus today is on crude oil and gold, with NYSE:USO and NYSE:GLD being the most common tickers discussed. Take a look at the chart of crude oil futures (above), and note accelerating trends with steeper slopes. It's not that stocks never do this--they certainly do--but commodities too this much more often, and these trends are much less prone to reversal. Again, temper your urge to fade.

There was a time in market history when S&P 500 traders (experienced, professional traders) flocked to the soybean pits to daytrade, thinking they could apply their ability from one market to another. That incident ended badly for the S&P traders (but very well for the locals in beans!) When we move into new markets, sometimes new skills or perspectives are required. Though there are other concerns with ETPs--liquidity, 24 hour trading vs. NYSE session, etc.--the most significant difference is the commodities trend better, further, and more often than stocks. Temper your urge to fade.