I have a confession to make: I’m trying to learn to do better marketing. I’m not the kind of person to brag about success—one of the reasons for that is probably a “gentle superstition” borne out long experience which tells me that any kind of hubris is quickly punished by the market. I’m immediately suspicious of anyone blasting their “great winning trades” all over social media: perhaps they are lying outright, perhaps they’ve only been trading 5 years and have never seen AMZN do anything but go up (never confuse genius with a bull market…)

But… I need to tell you about a great trade I made with my MarketLife Premium clients today because there are many solid lessons hidden within this trade.

Setup

From a fundamental perspective, one of the things I monitor are simple global measures of stress. Good first level measures might be inflation rate benchmark interest rates for each country. (Other measures, like joblessness and GDP contraction are consequences, and usually lag a bit too much to be useful.) So, by those measures, if I’d missed the news from previous quarters, I’d been generally aware that Argentina was on a short list of global economies under tremendous pressure. Lesson: if you focus on data you can remove a lot of the emotion and third party analysis that comes with news.

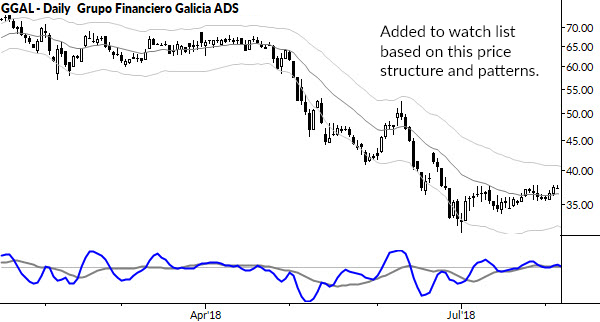

So, with that context, GGAL popped up on my candidate list as a potential short on or around 8/7/18. (Lesson: even with that fundamental wrapper, I didn’t go looking for Argentina—I let bottom up action drive my stock selection. To me, this is respecting the message of price action first.)

I did a little research to see if I was missing something. This was a big Argentinian bank (the fifth largest). Were there others listed in the US? (Yes, two others but they did a third of the average volume GGAL did, and were outside my liquidity parameters.) I always give some thinking to trading an ADR or ADS because of gap risk, but I judged it was a bit less here since Argentina faces the sun during our regular trading hours.

With that little bit of due diligence, I put the stock on a list we call “Adam’s List”, which is my curated list of the best long and short stock sets I see at any time—a watch list for my MarketLife clients, updated daily.

Entry

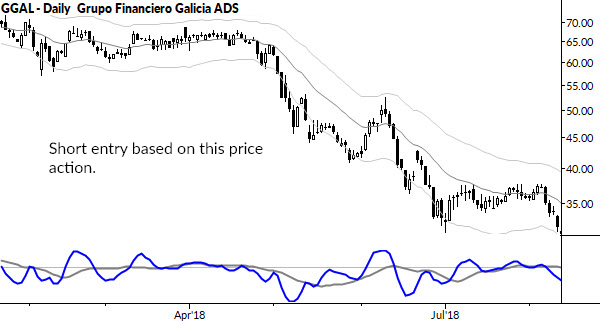

Having a setup is great, but jumping in to stocks with setups is a great way to lose money. In my experience, you’ll find your results are a lot better when you get some confirming momentum, so you’re effectively jumping on the train when it leaves the station.

This is a personal part of your trading plan, but it’s one that must carefully be defined. We watched GGAL for a few days. One possibility is just to work stop (stop limit) orders under recent lows or trendlines or other measures of support, so you’re swept into the trade when that support breaks. In this case, a reasonable trade entry would have been somewhere in the few days added to the chart above.

Lesson: the actual trade entry is not that important. It’s almost an experiment: “here’s this setup, which I think has an edge in this direction. Let’s see…”

Trade Management

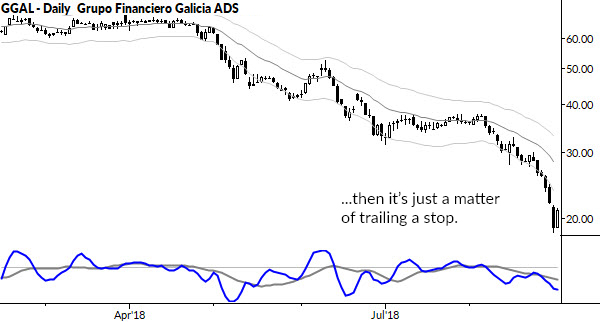

Trade management is another one of those aspects you must get right. When you’re right on trade direction, it’s relatively easy: just trail a stop each day. But how close? When to give something room and when to tighten? When do you go inside the previous bar? When do you not move the stop? Will you ever move the stop in direction of risk?

Again, that’s a laundry list of questions that have many possible answers, but I do think it’s important you have your own answers, and that those answers are consistent. Even for a discretionary trader (maybe “especially”), rules matter—you can’t be reinventing your trading system every trade.

(This, by the way, is another aspect we cover extensively for my MarketLife clients. You’ll see every day where and how I manage stops on trades, both in a general sense, and in a set of very specific trades in futures and currencies. (A set of trades that returned around +5.0R during the month of August, by the way…) One of the best ways to learn this skill is to watch someone else do it.)

So, then we were in the situation of just trailing a stop down as this stock collapsed. Even while the US market went up, and our longs were working out, this stock paid us handsomely on the short side. Today, we may well hit our trailing stop, but the stock went +48% in our favor from the time it was added to our list—that’s a solid move and there’s enough to play with that you should be ok, even if you just get a piece of it.

Lesson: you must have a process. Yes, this was an Argentinian bank at a time when the Argentinian economy came under extreme stress, but that doesn’t matter. I managed this trade just as I would have a trade in any other stock, or currency, or commodity. If you have a disciplined technical strategy, your job is simple: follow the rules. Follow the system.

Process…

Now, I’ve just shown you an exceptional trade. This is not normal–you should never expect that any system, methodology or source will give you trades that consistently go 50% in your favor. (And if you’re an options trader used to seeing services claim 200% trades, that’s a misunderstanding of how to measure results.) But, good trades like this will and do come to a solid methodology. I wrote this post to show you that great trades can come from a simple process. Essentially, we’re just selling pullbacks in downtrending stocks, and buying pullbacks in uptrending stocks. (Lesson: trading isn’t about having a new setup or some exciting pattern to talk about. Simple things work, and they keep working decade after decade.) This is how you build a process. This is a foundation upon which you can build a trading career.

Shameless plug: I’d like you to see what we’re doing at MarketLife. Today, through the end of Labor Day, sign up and use discount code marketlabor2018 for a 25% lifetime discount on your subscription. All our subscriptions are covered by our no-risk, “free lunch” (if you really think the service sucks, I’ll give you your money back and buy you lunch) guarantee. You literally have nothing to lose, and one trade like this could pay for years of service.

Go, sign up today, and see what a difference we can make in your trading.