Consistent Trading Through Repeating Patterns: Lessons from 3,800 Days of Market Study

Every day, I provide detailed market analysis for MarketLife members, focusing on daily setups. We focus primarily on the daily timeframe, and cover markets in two tranches: US-listed futures (and currency futures), and US stocks. We focus on directional trades that are drawn from my work, which you can find here on the blog or in many places online. These trades can be executed with options if you choose, and many of our members do so. Today, I want to share lessons I’ve learned from my side of the desk and walk you through a few current trades that capture the essence of targeted swing trading patterns.

Rhythm and Focus

Over the years, the discipline and rhythm of this work has been very important for me. I've been publishing market research daily since the end of 2009, first for institutional clients, and for MarketLife starting in 2019. As I'm writing this, I realize that's currently about 3,800 days of unbroken market analysis. (In fairness, I missed two days in 2012 when hurricane Sandy left the entire New York Metro area with no electricity or connectivity!)

Two critical lessons emerged from these years of discipline: first, the importance of unrelenting commitment, even when it feels like a burden; second, the value of keeping a complete, objective record of every thought and decision.

MarketLife may be the only commercial service that maintains a full archive and never edits or deletes old posts from our database. All of our members can go back years and see what I was saying or thinking at any point in the market. Sometimes this means seeing how I was wrong, but it's also instructive to see what happened after that. Being wrong in the market is fine; it's staying wrong that will take all your money.

Now, ask yourself: how can you build this level of consistency into your process? Are you utterly and completely consistent with your market work, or do you take long periods off? Do you miss days when trading isn't going well? What should you be doing, even through periods where you're not trading, to build your analytical toolkit? How can you have an accessible, objective record of your successes and errors in the market, beyond your P&L? Some time spent on these ideas will repay you with growth beyond your expectations.

Some Example Trades in Stocks

Let’s look at some recent examples to show how we apply these principles in real trades. We publish setups, long and short candidates, with initial stops. In the daily video, I discuss entry points and techniques, and also do a little bit of teaching around key concepts. Once our trade candidates have moved past entry points, we mark them "underway." Yesterday, I screenshot all of our underway stock trades. We have only longs underway, which is a reflection of the overall market environment.

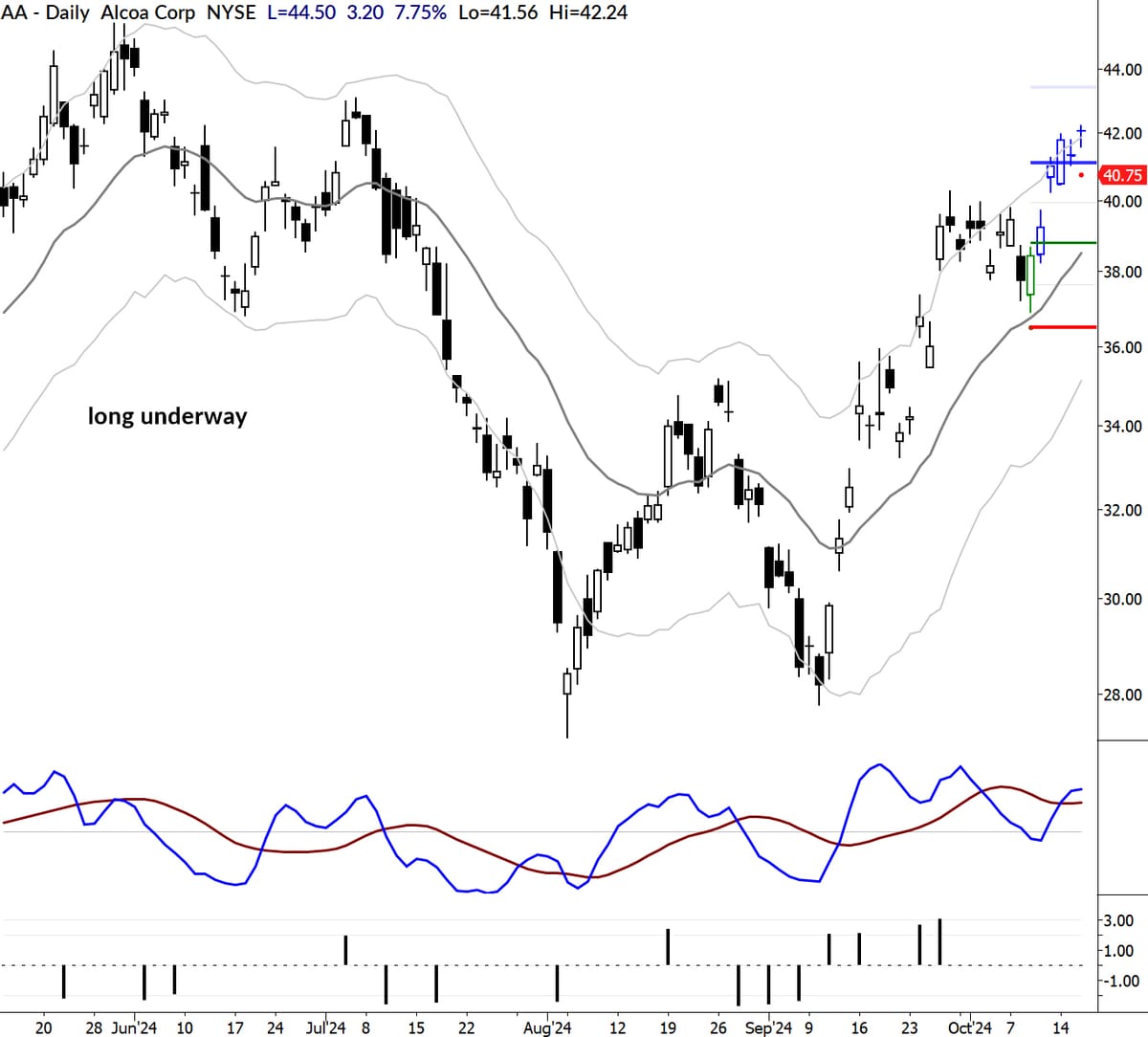

Alcoa is a good example of a long bull flag. The stock traded up to the upper channel and then pulled back in a controlled pattern. It went on our list as a long candidate on the close of the green bar. In this case, entry was the next day, triggered above that high. The green line shows the approximate entry price; the red and blue are the initial stop level and the 1R target level. Our members manage trades in different ways, and we suggest slightly different approaches to trade management depending on the market environment. (Small tweaks this like this can make a big difference in outcomes. It's a good way for you to put my decades of experience to work in your own trading!)

We had much discussion in the daily videos about the perils of holding full-sized positions into earnings. In this case, Alcoa reported after the close of the last bar of the chart, traded much higher overnight, and hit our raised stop around 42.00 the next day--a solid trade.

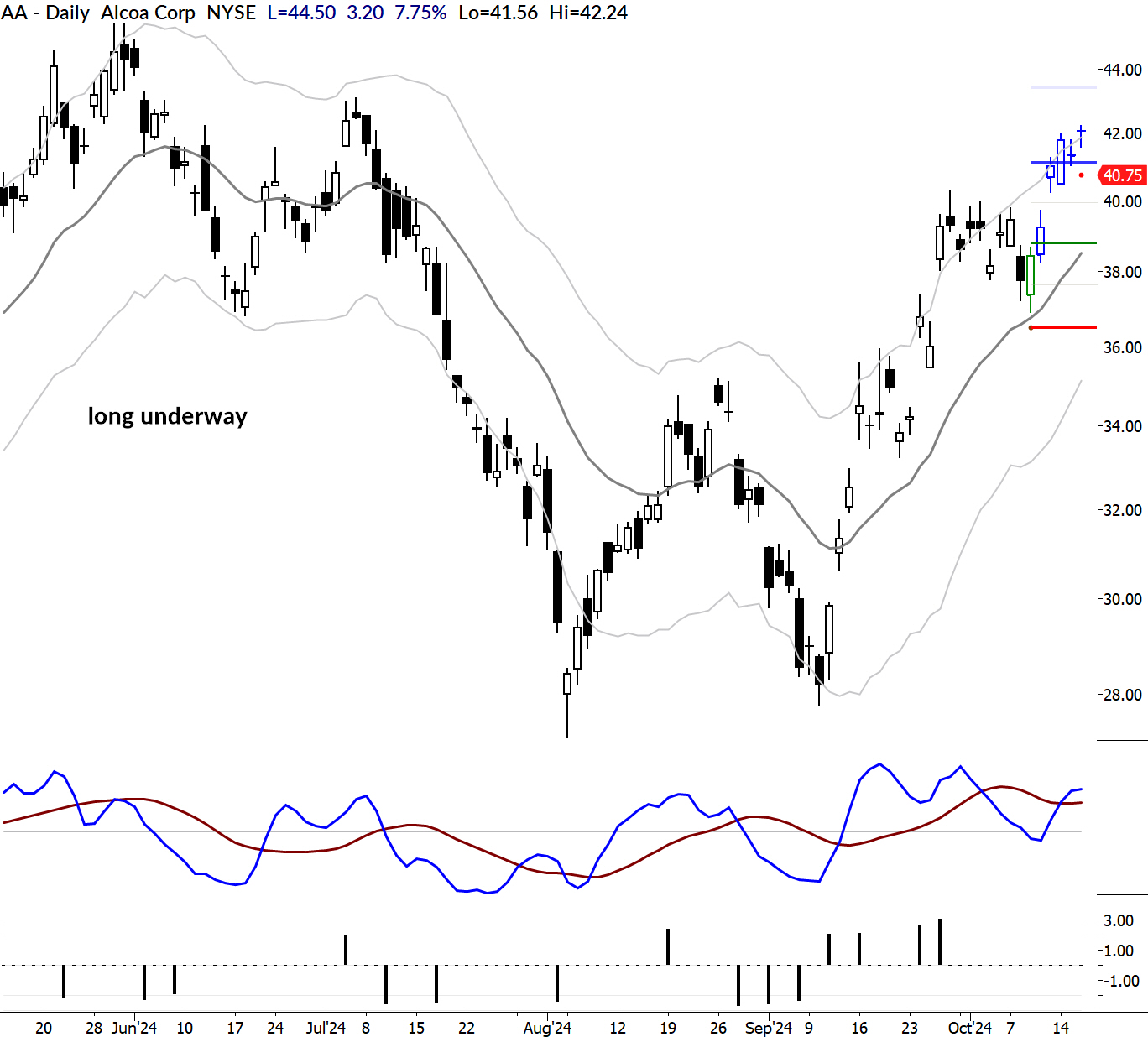

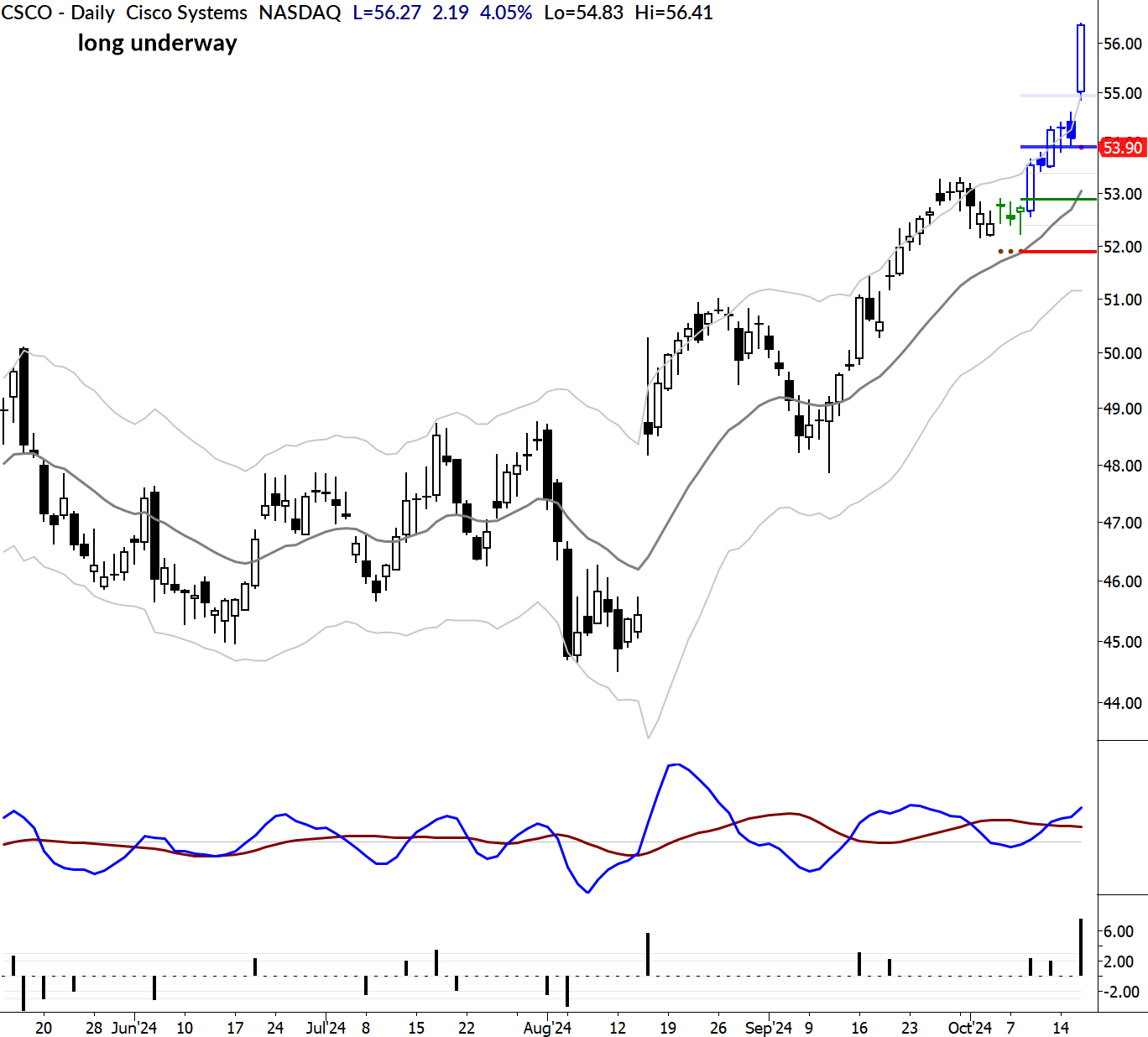

Blackstone (BX) was another example in a bull flag. There's a bit of nuance to finding these patterns, but you can see we're leaning on the same patterns over and over. It's not about making "killer plays;" it's about building consistency.

BX also reported and traded up sharply the next day. This was, indeed, a killer play.

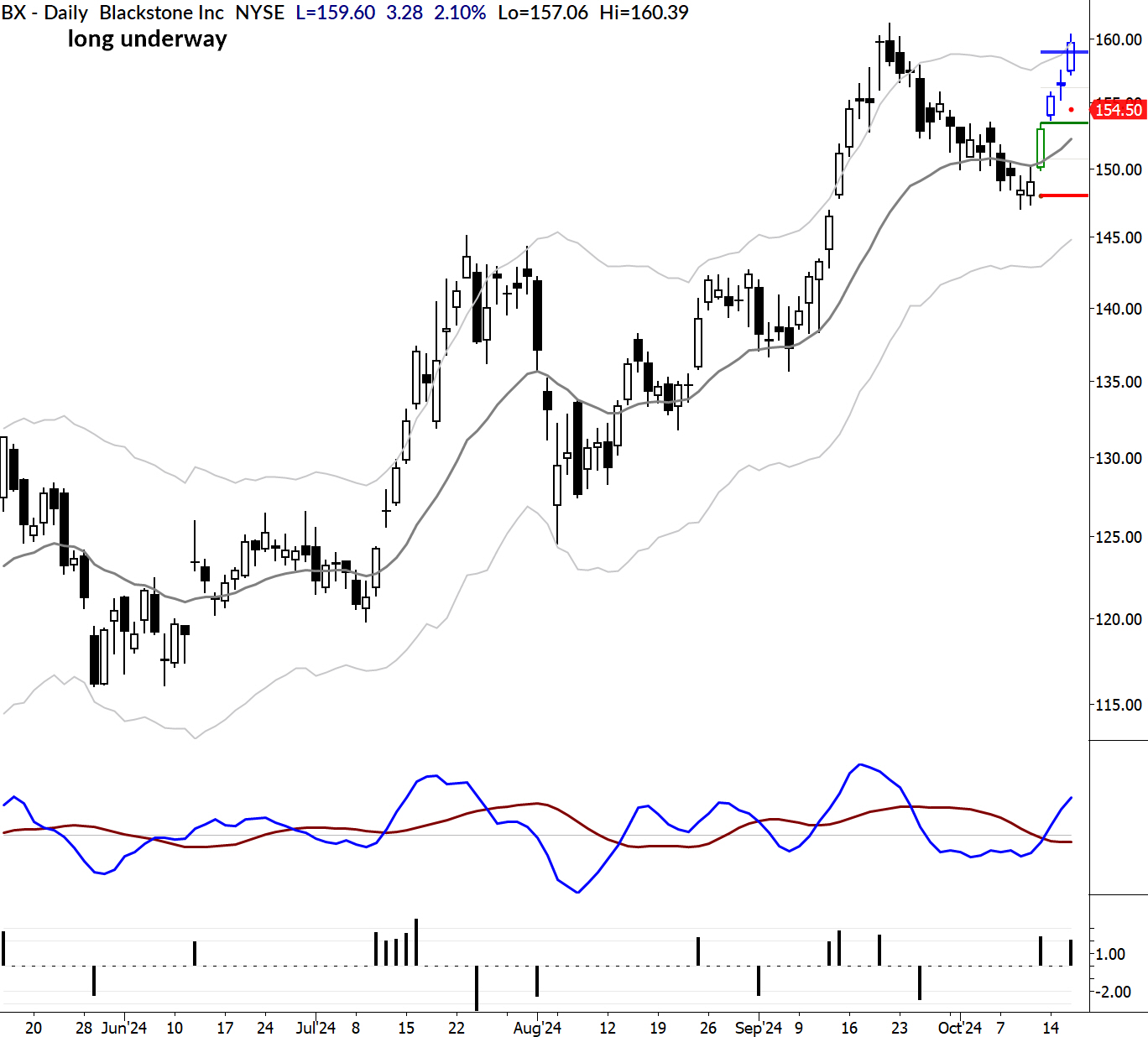

Are you seeing a pattern yet? Here's another bull flag with an easy entry following a pullback, and then a clean move up through the first target at 1R. This trade presented several opportunities for entry further along as well.

The winners almost take care of themselves; the losing trades require the right mindset. CZR failed after the initial entry bar. We don't spend a lot of time dissecting the details of patterns. In my experience, there's not a lot of utility in doing that. It's enough (and it's all we can do) to find the right kind of patterns in the right kind of stocks in the right kind of market environment, and then to put on and manage the trade.

If you're ready to apply these strategies to your own trading, join us at MarketLife and gain access to daily market analysis, trade setups, and insights built on decades of experience. Right now, you can take advantage of our limited Fall discount with the code SPOOKY25—but the 25% discount only lasts until the end of October 2024. I hope to see you in our live sessions soon. Happy trading!