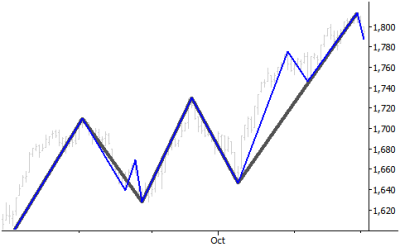

Swing charts can clarify structure and eliminate noise. This is a daily chart of the S&P 500 (cash index) with our AlgoSwings® indicator applied on two timeframes. This tool does a fantastic job of eliminating the noise and highlighting the important market structure (but remember that it is a backward-looking tool—you cannot trade the structure quite as easily at the hard right edge of the chart.) Today, the media and twitter feed were full of speculation about whether this is the end of rally, etc. My advice would be to shut all that out and focus on price and market structure—price is all that pays and this is all that matters. In this case, it’s clear that the recent “selloff” is only a natural decline, and that the market would have to decline well below 1750 to raise any significant concerns about the health of the trend. Cultivate balance and control and avoid hype and emotional reactions to normal market movements.

what is it in price that we search for and why do you say 1750 is important? whats so important about it?

Because if it will go below 1750, it will make a lower low, which will raise some warnings.

It’s a rough area and just an approximation. For the intermediate term trader, we don’t care about any decline anywhere above that area, so all of the talk of corrections and crashes is just silly at this point. (But BI has to find something to sensationalize and I guess today they picked a 0.5% decline in the S&P lol.)

lol ya they need something to complain about. ITS ALL A CONSPIRACY!!!! haha jk jk

on another note, im not sure that this is the best place to tell you about this but i dont have your email or anything…on your website, the link on the tab bar above named “Waverly Advisors Research” has two spelling errors that I noticed while reading it. The first paragraph on the last sentence says “and many other clients fine useful “…im assuming “fine” should be “find”…and the 2nd to last sentence of the whole page says “no-obligation trail of our research”…’trail” should be “trial”…sorry to point those out to you, just thought you would like to have them fixed…thanks for all the information =)

There is a small swing bottom around 1780. If that low is taken out would you consider it as a change in trend.

Manish, that is a very timely question. The short answer is no that would not be a technical change of trend because a downtrend requires a lower high and a lower low. The longer (and much better) answer would be to say that a change of trend, per se, is not nearly as significant as most people would like to believe. This is a major topic of week 3 of the trading course, so please check out that material once I get it published (in 2-3 days!)

Thank you for your question.

Adam I find your course very informative…. u know what i take your advice seriously bought a chart book and started hand plotting the charts……i do it for two indices as of now . i did it from Nov 2013. just one bar at a time….. no frills no fancy computers… simple price action… I plan to add 2-3 stocks every week..

Regards,

Manish