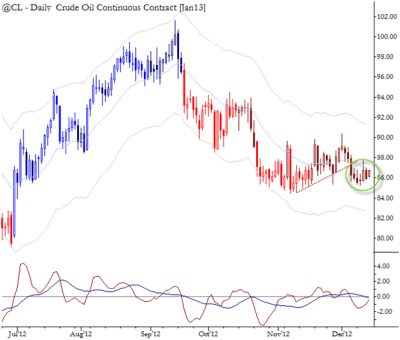

Chart of the Day: Nested Pullback in Crude Oil

Crude Oil is consolidating lower following the break of the trendline. This pattern is perhaps more clear on the weekly chart, but it appears to be a small daily consolidation pointing lower. I used the term "nested pullback" in The Art & Science of Technical Analysis to refer to this pattern: a small, lower timeframe consolidation that occurs within the resolution of a directional, higher timeframe pattern. These trades can offer exceptional reward/risk characteristics with strong probability of a profitable resolution.

(Note that USO can be used to execute this trade, rather than futures, but be mindful of overnight gap risk.)

// < ![CDATA[ <span style="overflow:hidden;line-height:0px" data-mce-style="overflow:hidden;line-height:0px" id="mce_0_start" data-mce-type="bookmark"> // ]]>