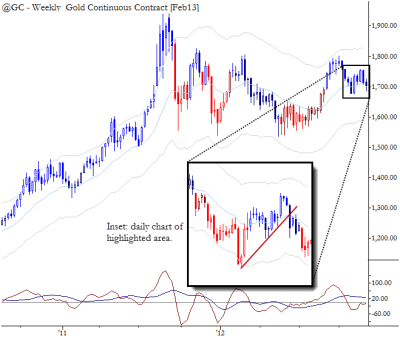

Chart of the Day: Gold: Set for a Breakdown?

Continued from this chart earlier this week, Gold shows further evidence of breaking down. If you do not have a position, use small daily consolidations to position short, for example, entering on a stop (or a stop-close-only) below yesterday's low. You are still essentially trading a weekly pattern, so wide stops are justified. This trade has potential at least down to the mid 1,500's, with the possibility of a dramatic breakdown below that level.

Short Gold is currently unpopular, and, frankly, it looks like a stupid trade to many people. That's ok because we get paid for assuming the right risks at the right time and then managing those risks appropriately. Should Gold turn around and head higher (which is perfectly possible—we cannot and do not try to predict the future), then we'll simply book a loss on the trade and move on. Should Gold break down significantly over the next several months, those of us shorting here will look like prescient geniuses. Of course, this isn't true. We're doing all we can do, which is taking the small probabilities offered by the market with perfect discipline, and paying much more attention to the potential risk than to the possible profit.

// < ![CDATA[ <span style="overflow:hidden;line-height:0px" data-mce-style="overflow:hidden;line-height:0px" id="mce_0_start" data-mce-type="bookmark"> // ]]>