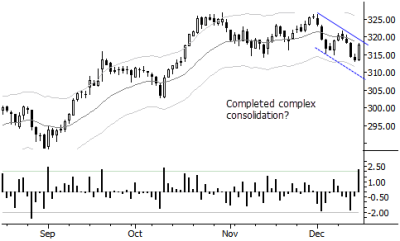

Chart of the Day: Complex Consolidation in European Stocks

The daily chart of the DJ Europe Stock Index shows a two-legged pullback that could be read as a complex consolidation. This is typically a strongly bullish pattern, and we see similar structures in many other global indexes. Yesterday's large standard deviation up close is a breakout on lower timeframes and "should" see clean continuation to new highs. There is also value here if this pattern fails—a failure would likely presage a more protracted pullback, leading to several weeks of sideways/downward prices, perhaps testing the parallel trend channel (dotted line) or below. This is one of the fundamental trading patterns I covered in my book, and we will be covering this coming week in my online trading course.