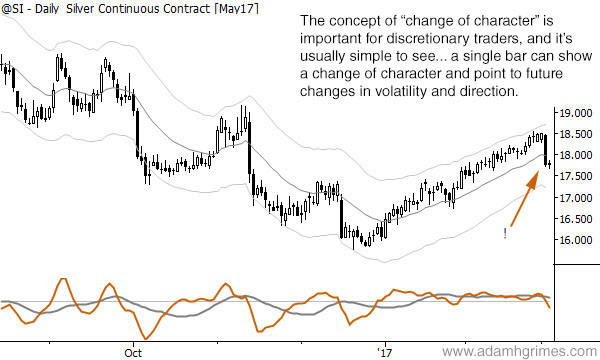

Chart of the day: Change of character in silver

- Post author:AdamHGrimes

- Post published:03/03/2017

- Post category:Chart of the Day

AdamHGrimes

Adam Grimes has over two decades of experience in the industry as a trader, analyst and system developer. The author of a best-selling trading book, he has traded for his own account, for a top prop firm, and spent several years at the New York Mercantile Exchange. He focuses on the intersection of quantitative analysis and discretionary trading, and has a talent for teaching and helping traders find their own way in the market.

You Might Also Like

This Post Has 3 Comments

Comments are closed.

Hi Adam, basically it’s a long bar which is taking out high and lows of multiple preceding bars. In the same chart we have other 3 bars like the one which you pointed out. All of them are related to a “change of character”? Thanks a lot!

https://uploads.disquscdn.com/images/628490fb633049b178d207e53d74a53df4497803fe232892828d7db1a65da947.jpg

Jean, I had actually similar thoughts. After a few days of reflection I take the liberty to give my personal answer as “peer feedback”. 🙂

First a small correction to what you wrote: in fact the particular move is only taking out lows (I learned to be picky with language, sorry).

I agree there are quite similar bars, although there are subtle differences in

a) Set-up leg. No other set-up leg is as long as the recent one.

b) Position from where it starts. This one retraces after touching almost upper Keltner band

c) Position where it ends. This one only retraces to the middle of the band, while the others went straight to the lower Keltner band into new lows and likely into overbought territory.

d) HTF. The previous set-up legs were simple pullbacks in a HTF downtrend while the recent leg is the first to seriously challenge the HTF downtrend.

Especially the last point seems important. If instead of the big black bar we’d see a rather shallow pullback, we’d likely see a constructive set-up for an Anti long on the HTF. But the big down sigma indicates a change of character, the upside move is challenged. In the prior moves there was no real set-up for long, so there was also no “change in character”.

Now what does that mean in terms of trading? I’d say sometimes it is enough to avoid damage, i.e. not entering long here after this potential change in character. This is what I did. I did not find the short set-up attractive, especially after the 3 previous situations which did not see good follow through.

I am writing this 2 bars after when there is another very tight consolidation and a potential further breakdown. The set-up seems a promising Anti short on the TTF and I may consider entry tomorrow in case the breakdown today does not happen. For today I stay at the sidelines as my trading plan did not consider this and I want to avoid impulsive trading jumping.

Hi, thanks a lot for sharing your tought. At this point it would be interesting to know also Adam’s opinion!