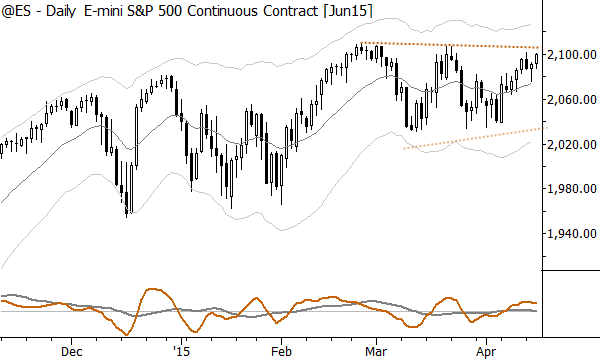

I’ve been writing about this for quite a while, tweeting about it, pointing out the relative strength in smaller cap names, constructive sector flows, volatility compression that could support a strong trend thrust, and a number of other factors–US stock indexes are well set up for an upside breakout. Take a look at the S&P 500 futures:

There are also good reasons to like smaller cap names, and the Russell 2000 is equally (or perhaps better) set up to run:

There’s tremendous upside potential here, but there’s also danger. These trades may be “obvious” enough to enough traders that there could be many technically-motivated traders executing at these levels. That’s fine–I think we have to fight the urge to be contrarian. Be a contrarian, yes, but do so when it makes sense; there are many times when we should join the crowd, even if that crowd is a little bit irrational.

But, we do have to be prepared for the types of failures we could see if these breakouts reverse. That’s fine, too. Use correct stops for your trading style, and perhaps even be prepared to take reversal trades on clear failures. (The failure test could be a useful pattern if the market fails.) Don’t stress about the possibilities and worry about possible losses–instead, plan. Plan, and execute.

Keep an eye on those breakouts; let’s see where we end up in a few weeks.

Actually, if you look at the advance decline line it is very bullish as well, and is already past prior highs. Don’t fight the central banks…