Beyond the News: A Dive Into Breakout Behavior

Here are a few quick lessons drawn from today’s (Monday 10/9/23) action in the S&P 500 futures.

Of course, we could draw many lessons any time we look at a section of market data, but when we choose something to focus on, we’re undoubtedly missing other aspects. Today, I want to focus on two aspects: pinpointing when the tone of the day became clear and examining some specifics of action around breakout points.

Overall direction

Markets have been under pressure for many weeks. Bears have been in control, and we’ve seen several great shorts in indexes. However, last week ended with some signs that the bears might have been running out of ammunition, as a number of patterns suggested an upswing was a bit overdue.

This weekend saw some disturbing news, with an eruption of open, armed conflict between Israel and Palestine with significant loss of life. If the media (social media as well as mainstream media) are to be trusted, there’s a really good chance this will turn into World War 3, and we should be in full-on panic mode!

Or should we?

One of the recurring themes of the market is that reaction to news events is often counterintuitive. While amateur traders might rush to short a market based on what is perceived as bad news, professional traders know that bad news is often a catalyst for a reaction in the other direction.

The way I think of it is that negative news is a concrete thing—once something appears as a news story, many uncertainties resolve. Even if the news story carries significant negatives, the realization of it as a “thing” contains the seed of a counterintuitive reaction in the market. In addition, many amateur and ill-informed traders probably do take action with the perceived news, so they provide ready fuel for the move in the other direction.

This is a story as old as the market itself, and it’s one you need to learn from if you’re going to trade for very long. Don’t expect easy trades based on superficial readings of news.

Reading market dynamics

We also saw a typical reaction playing out in this session. The market opened down (seemingly “correctly”) in response to the news, about 30 S&P points, and spent much of the European session trading sideways.

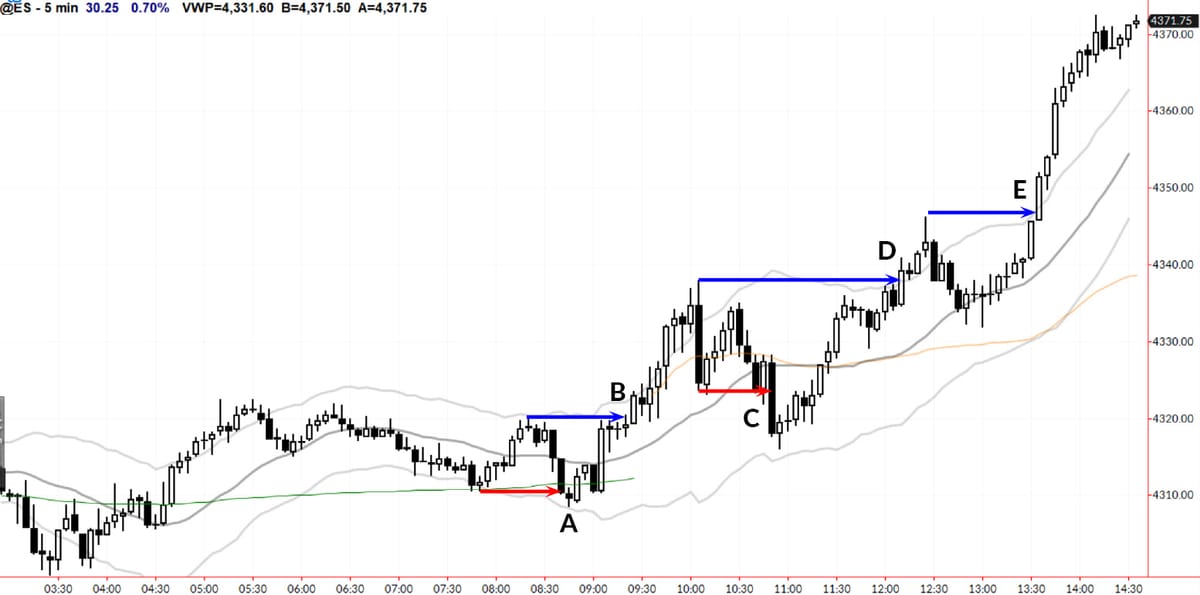

When US markets opened (note: a minor holiday so we expected volume to be lighter), one thing was clear: the bears were not in control. We saw a failed breakout attempt (A) in the premarket, and early strength.

Take a look at the big bar just after 10 AM (on the chart, the bar that has both blue and red lines attached to its high and low). This bar was important; a significant failure at the high, with a large range, can often mark a high point for the day.

The reaction took the market below VWAP (orange line), and traders were smart to consider downside breakouts at C.

The failure of that breakout was important—it led to a consolidation under the highs, and then a push to new highs on new momentum. If you had to pick a single point where it made sense to look for significant upside, the consolidation before D was probably the spot. (Astute traders might have taken a lot of information from the failure of the bears after C, but this was still a bit speculative and not at all clear.)

If you’re a newer trader, it’s enough to have avoided trading heavily on the short side today. If you’re a bit more experienced, I think a long bias was clearly justified based on the premarket, and then the game became seeing how robust that long bias should be.

This is a framework that you can use, day after day, but it’s not cookie cutter—you must adapt this for market conditions. The concepts matter much more than the specifics.

Breakout dynamics

This day also provided us with some good examples of breakout trades and action around breakout levels. Rather than write extensively here, I would invite you to listen to the relevant section of my most recent Hudson Sessions talk, in which I spent quite a bit of time looking at action around these levels.

You can find that playback here.

Once you’ve done that, take a careful look at the points I marked with letter names in the chart above. The point marked (A) was probably not a great trade, unless we were looking for a premarket breakdown. The others, however, are pretty solid trade setups.

Spend some time considering how clean (or not) the follow-through was. Was there pre-breakout consolidation? Was the level broken cleanly with good momentum, or was there noise? Was the level retested after the break? Was there a clean consolidation before and/or after the breakout?

Which of these factors seem to affect the outcome of the trade? Consider the move in context of your trade management rules—not every breakout needs to go to the moon to be a good trade!