There are many things I love about the markets. Yes, I love the idea of getting paid for solving the puzzle or playing the game. I love learning. I even love being proven wrong when it points me to new growing edges and new areas to explore. But maybe most of all, what I love most is the quest for knowledge. Lately, I’ve been up to my elbows in code and data, and I’m excited to share some results with you.

Evaluating Trading Ideas

Knowledge in trading is not simple. Of course, it boils down to “Does it work?”, but it’s never quite that simple. A tool can work for one trader and completely fail for another. This is because performance is the sum of every piece of the trader’s methodology, plus mindset. I’ve found it useful to evaluate pieces separately, questing for strong evidence of a statistical edge in individual tools.

The gold standard of any quantitative testing is out-of-sample data. This is a deep topic, and it can rarely be done properly. (Technically, you get one shot at out-of-sample data and can’t modify anything afterwards. You could even argue that data is not out-of-sample if the trader lived through and traded through the time period.) Even better is doing live out-of-sample testing, and that’s what we’ve been able to do here.

The MarketLife Tools

We launched MarketLife in 2019 with a set of quantitative tools and screens designed to guide dedicated traders. Many of these tools were ones I had used in my own trading for over a decade, some of which were provided to major hedge funds on a subscription basis. Since then, we’ve made no changes to the algorithms. Now, five years later, we’re in the perfect position to ask: Do they work?

I’m in the middle of a major quant project looking at many of our tools and distilling the findings into a set of white papers. Today, I want to share the first of these papers with you: Evaluating Pullback Buy/Sell Signals: MarketLife’s Stock Scans. You can access the full paper here, and more will be added to that library in the coming weeks.

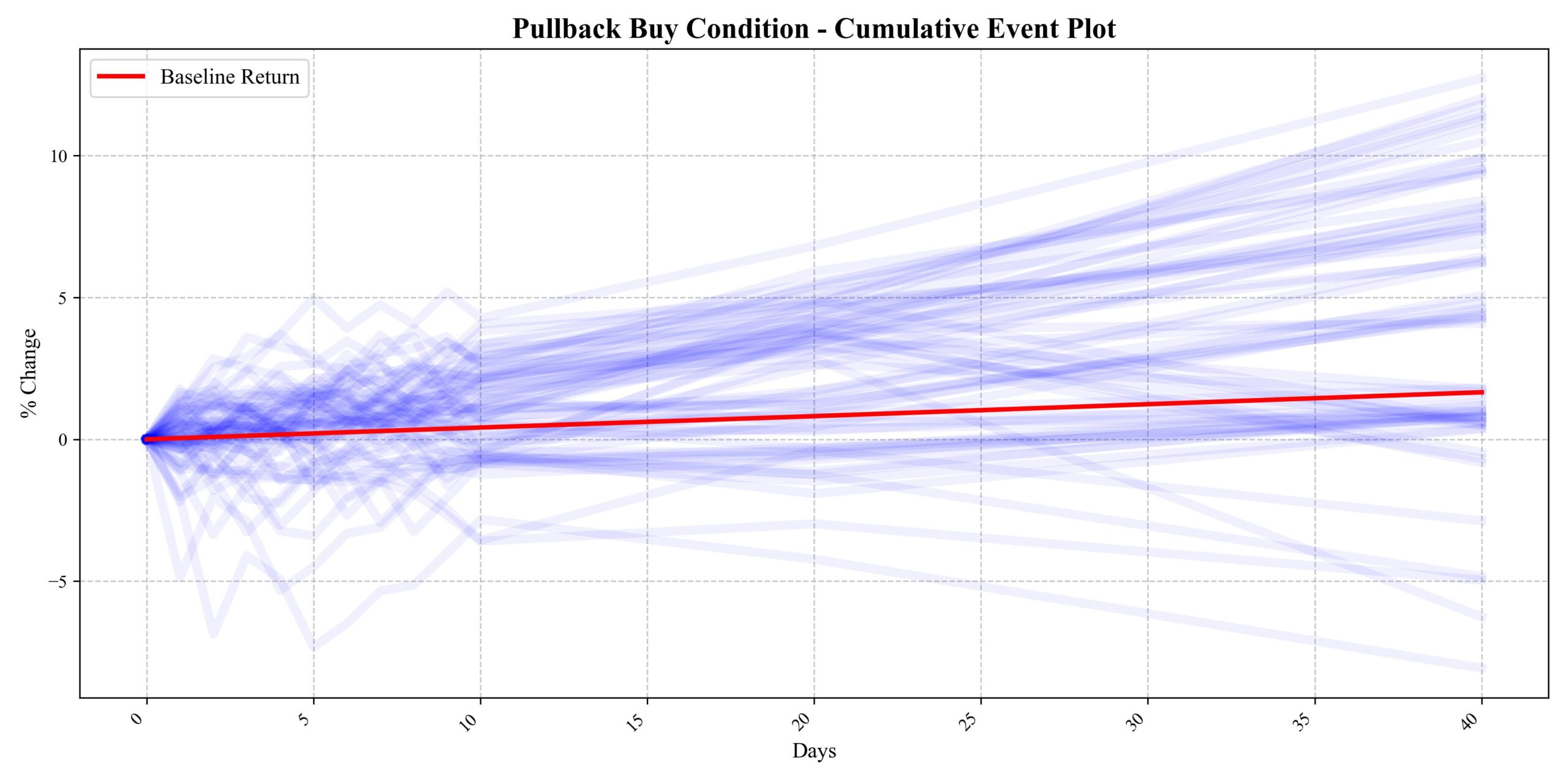

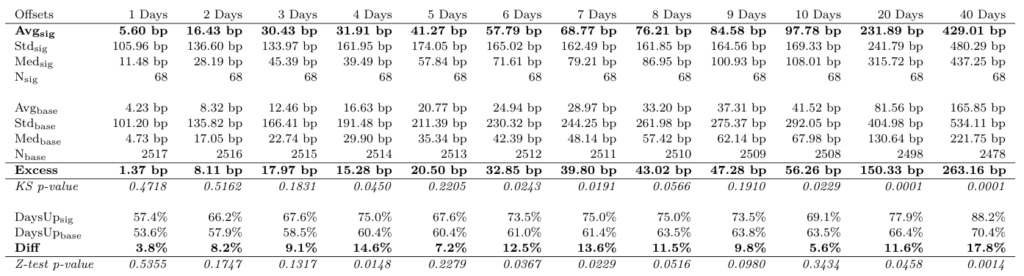

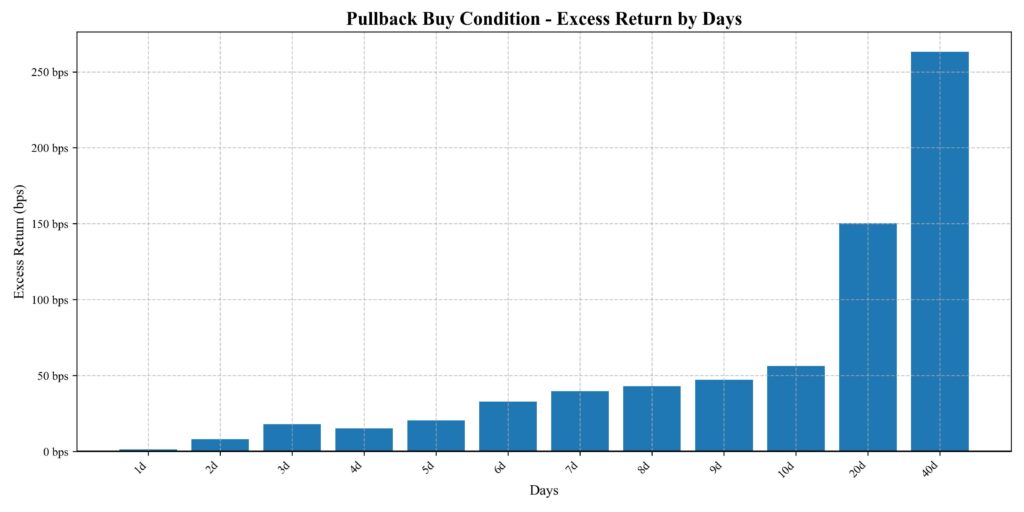

There’s probably more quant detail than you want in that paper, but let me share two tables with you that make the point:

These tools work. Both the buy and sell signals show a clear edge that is both economically and statistically significant. They have held strong through every variation of market condition and macro event. We’ve crystallized in code one of the core principles of market behavior. To put it very simply—it works.

Using Screens or Scans

There’s a lot of focus online on creating and finding the best stock scans—and for good reason. There are literally thousands of tickers, and manually sorting through them to find the few you want to trade is a daunting task.

I think of a good screen like this the same way I think of an analyst or a trading assistant. “You go do the work and bring me a candidate list. I’ll decide what to do with it.” Both parts of this are important—yes, it’s easy to create screens in trading platforms or on websites, but, to be blunt, most of those suck. If you’re looking at things like relationships to moving averages you’re already stacking the deck with quantitative tools that don’t offer an edge. Most platforms can’t handle the kind of logic that drives these screens—they are pieces of actual trading systems.

But once you have a good quant tool, there’s another step: knowing what to do with those candidates. Which ones will you trade? How many will you trade? (This is a critical assessment of overall market risk and favorability.) How will you manage those trades? These questions, and many more, must be answered consistently before you can execute with consistency.

MarketLife

That’s what we strive to do at MarketLife. I produce daily videos showing you how I’m analyzing the market and where I think the best opportunities are. This pullback screen is one tool among many that we use to identify trading candidates. The edge in this tool is just one verification of our overall approach to the markets.

We’re offering a special 25% autumn discount for a limited time. Use this link and the code spooky25 before October 31, 2024. Join the MarketLife family today and put these tools, insights, and strategies to work for you. Whether you’re looking to refine your approach or start your journey with a proven edge, I’m confident you’ll find value in our rigorous, discretionary trading strategies—rooted in deep experience and backed by hard data.