Thinking in checklists is useful, especially for shorter-term traders. Every market situation is full of rich and complex nuance. Every moment in the market (or in life) is unique because the precise conditions that have existed before do not exist this time.

We cannot possibly hope to deal with the unknowable depth of complexity, and so we simplify. If we simplify correctly, then we can identify key points of a market’s structure and behavior that help us frame out a trade.

Today, I saw many elements early on that tilted the scales in favor of stock indexes having a trend day up. So far, the followthrough has been somewhat weak, but the lessons are valid and will help you on other days.

What were the elements that warned me to be very careful with swing short positions early on? (And, to be perfectly honest, I came into the day carrying some short exposure!)

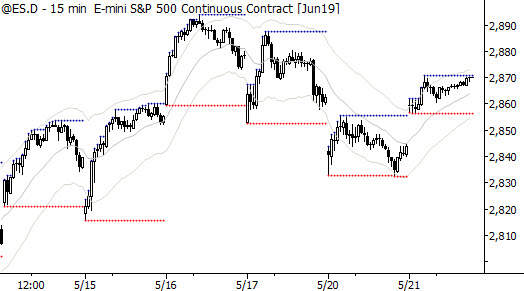

Take a look at the 15 minute chart above, which marks each days’ high and low in blue and red dotted lines. Though not easily visible on this chart, the previous day’s range was a tight range day. The day session only and cash charts of the S&P 500 showed NR7 (meaning the range was the narrowest of the last 7 days.) This is a condition that sets up a higher probability of a trending session today.

So that was the setup coming in to the day. On the open, we could see:

- The market opened above the previous day’s high.

- Early action was tight consolidation for the first hour of the day. (Look closely at the first four bars of the last day on the chart.)

- At no point did the market drop below the previous day’s high. The market found support at that previous day’s high.

None of the above conditions could be read as bearish. (A gap up opening that sells off immediately could be, but this gap opening immediately consolidated sideways.) Combined with the narrow range session the previous day, which gives us a high probability of a trending session, we have every reason to lean long.

From this point, you had to follow price action. The first breakout of the tight opening range (which, in this case, lasted nearly an hour) led to an unchallenged rally to new highs. As I’m writing this, we’re turning the corner into the last hour of the day. The market often stalls out and reverses here, but we are pressing against highs (simple gut check: market at highs is not bearish!) and intraday swing traders should be protecting profits with trailing stops.

Simple elements of market structure can give a strong edge to position trades during the day. Pick your spots. Manage your trades, and manage your risk.