[This post was originally published on SeeItMarket.com, here. I have added some comments at the end of the post to update following yesterday’s action. Despite the fact the market rallied instead of selling off, there are several points to consider in this post.]

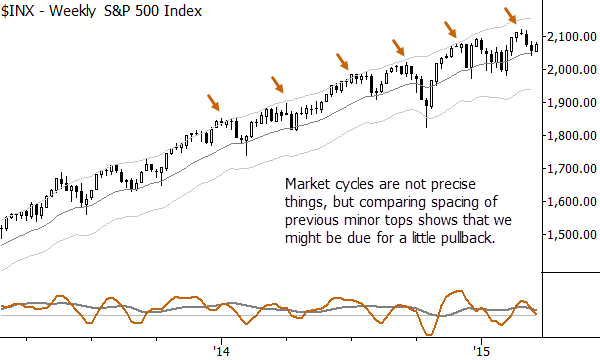

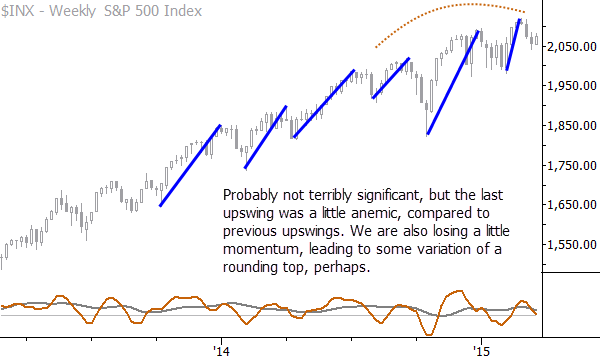

For context: I’ve been bullish on stocks for many years and I’m still very bullish over the longer term (4+ months). However, there are a few factors that are aligning here to create some risks for stock market bulls. This is a story that might be best told in pictures, so here’s a ‘chart roll’ that captures the current S&P 500 chart setup.

The latest upswing appears to be losing momentum and this makes the current S&P 500 chart setup a bit weaker.

If we do indeed rollover, here’s a look at where the S&P 500 might be headed.

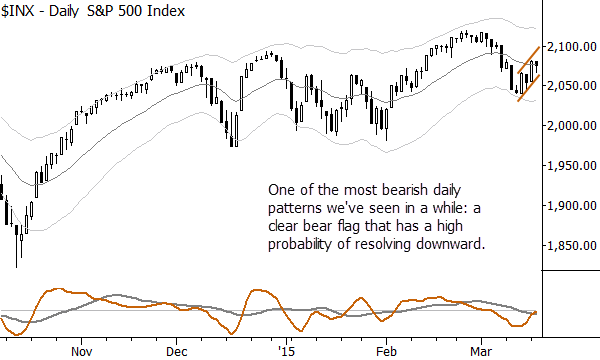

Today’s FOMC statement could be a catalyst that moves markets significantly. One of the key ways I phrase market moves for research clients is by laying out scenarios (we don’t know if this market will break up or break down today so we need to think about both) and appropriate actions for each of those scenarios (if it breaks down, due to these bearish factors, we do not want to be quick to buy weakness). This is not at all a call for a market crash, but it is a warning: buying the dip has been a trade that has worked well for many quarters, and we’d be reluctant to buy any dip today. There is maybe just a bit too much coiled bearish potential for comfort in the current S&P 500 chart setup. Longer-term, everything we see still points up, so there quite likely will be a spot to buy selloffs—just err on the side of caution today.

Update [the next day]: So the market rallied strongly, and nearly everything in the world saw a pretty volatile reversal from current trends, at least for a day. (Probably because most of the trades and markets we follow are heavily USD-influenced.) A few points to consider:

- Even if you’d been looking for shorts, you should have had no entry trigger (if you are entering with short-term momentum), so no “damage” was done in this market rally.

- Even though the pattern did not play out (yet), there is still great value in considering patterns like this from a risk management perspective–it’s good to know when to buy dips, and when it might not be a good idea. When you have a lot of coiled bearish potential in a market, it might not be a good idea.

- Last, there “should have” been more followthrough. We are still within that bear flag. There is still downward potential there. It is interesting to see buying not lead to more buying; a pop like we saw yesterday generally has 2-3 days followthrough.

Bottom line: still plenty of room for caution in the short-term here, but the longer-term setup is strongly bullish for stocks.

“Last, there

“should have” been more followthrough. We are still within that bear flag.

There is still downward potential there. It is interesting to see buying not

lead to more buying; a pop like we saw yesterday generally has 2-3 days

followthrough.”

yes,

I felt that today too, not enough bravado after yesterday’s strut… I took

some long inside bar nibbles so wish me luck – it could well just be delayed –

but the latency still hangs there in the air – for a day or two…